The Darktrace (LSE:DARK) IPO saw shares of the cybersecurity firm priced at 250p. Then strong demand during conditional dealing drove the price to 350p. This morning, Darktrace shares hit the London Stock Exchange and currently trade at 344p, valuing the company at around £2.2bn.

Cybersecurity is a growing market, and Darktrace has an apparently unique offering. Revenue is growing strongly, and there’s a path to profit. However, clouds are hanging over the IPO. Darktrace could well have been priced at closer to £4bn. But, the high-profile weakness of the Deliveroo IPO and links to Mike Lynch, the founder of Autonomy, and others embroiled in US fraud charges, may have contributed to a discounted IPO price.

Growing company

So what shape is the business in? Although Darktrace’s reported annual revenue growth is slowing, it was still high at 43% from 2019 to 2020. Customer numbers more than doubled, from 1,659 to 3,858, from 2018 to 2020, the average revenue per customer increased from $48k to $52k. It reported operating losses of nearly $25m in 2020, but losses have been shrinking as all recurring costs are falling as a percentage of revenue. If the trends continue, there’s a path to making an operating profit. Given that Darktrace has relatively modest financing costs, a net profit could follow soon after.

Darktrace sees its total addressable market (TAM) at $40bn. Assuming that’s an accurate calculation, then the company has a small 0.5% market share. That would suggest ample room for continued revenue growth, particularly if the TAM grows as fast as the broader information security and risk management market. Gartner, a research and advisory firm, thinks the broader market will grow 8.2% per annum through 2024.

Artificial intelligence

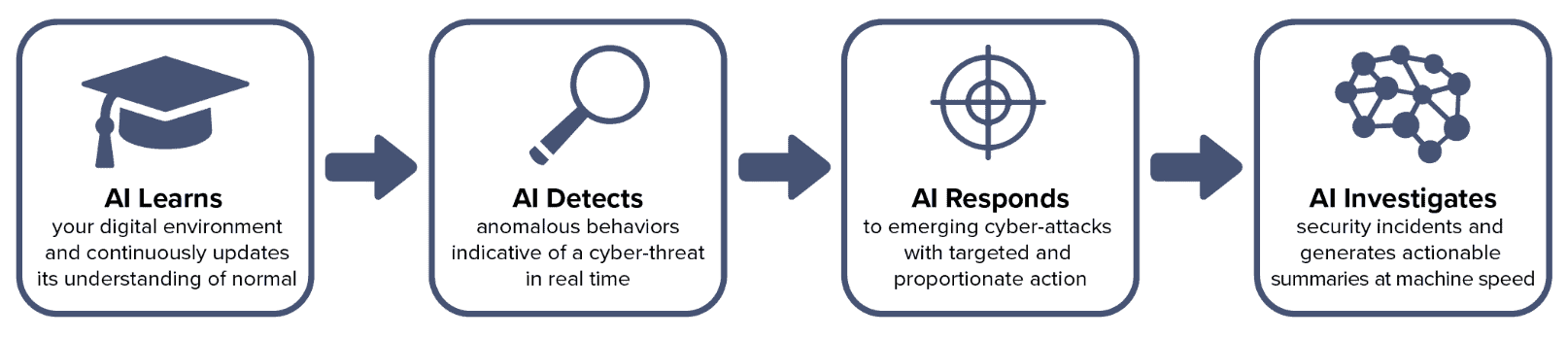

Darktrace’s product leverages machine learning to discover the normal digital behaviour of an organisation and thus detect, respond and investigate deviations from that behaviour that may represent a cyberthreat. By contrast, other defence solutions, like antivirus and firewalls, typically block and detect known threats. Darktrace appears to have a compelling offering.

Source: company presentation

Darktrace risks

However, as I mentioned, the company faces potentially significant legal and reputational risks arising from its association with Mike Lynch. Mr Lynch founded Autonomy, which Hewlett-Packard bought in 2011. Mr Lynch founded Invoke Capital Partners with the Autonomy sale money, and Invoke was an early investor in Darktrace. Furthermore, Invoke and Mr Lynch provided managerial and technical support to Darktrace until fairly recently. Mr Lynch and others have been charged with fraud in the US relating to accounting irregularities at Autonomy, and extradition hearings are underway.

There are no suggestions of accounting irregularities at Darktrace, nor any evidence of wrongdoing by its management. But Darktrace has been accused of using aggressive sales tactics like Autonomy was. Sales and marketing expenses account for 82% of operating costs, well above Avast and Norton’s (22% and 16%). The review website Glassdoor reports a 2.6 out of five satisfaction score for Darktrace sales staff.

Of course, spending a lot on sales isn’t unusual for a young company trying to build a presence. And disgruntled workers aren’t unique to the firm. But investors might one day perceive the personnel links (Darktrace’s CEO worked at Autonomy and Invoke) and the apparent inheritance of Autonomy culture as problematic. That’s beyond Mr Lynch’s 20% stake in the Darktrace IPO. So until the fraud case is resolved, I won’t be buying the shares.