On Monday morning, I wrote a rather bearish article on easyJet (LSE: EZJ) shares. Noting that easyJet had been forced to scale back its flying schedule due to lockdown measures and that analysts were downgrading EPS forecasts, I said that EZJ shares were risky.

It’s fair to say that article didn’t age well! A few hours after it was published, news of Pfizer’s Covid-19 vaccine broke, and easyJet’s share price jumped 35%. Clearly, a lot of investors see a vaccine as a game-changer for the airline industry.

Would I invest in easyJet and other airline stocks such as IAG (LSE: IAG) now that an effective vaccine may not be too far off? No, I wouldn’t. I remain convinced that from a long-term investment point of view, there are much better stocks to buy.

“A machine for losing money”

In the short term, there’s every chance that easyJet and IAG shares could keep rising. After all, these stocks have been well and truly hammered this year. EasyJet, for example, is still down nearly 50% year to date.

History shows though that in the long run, airlines tend to be poor investments. One reason for this is that the airline industry is extremely capital intensive. To keep a large fleet of planes running smoothly costs a colossal amount of money.

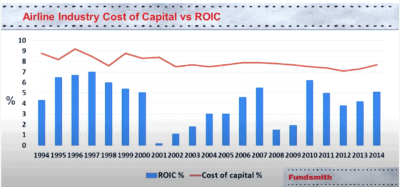

Given the huge costs they face, most airlines simply don’t earn a return above their cost of capital over the long term. This means that they end up destroying shareholder wealth. Fundsmith manager Terry Smith explains this concept well in a video here. Smith says that airlines are a “truly awful sector” from an investment standpoint and that they are a “machine for losing money.”

Source: Fundsmith

The world’s greatest investor, Warren Buffett, has a similar view on airline stocks. “The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines,” he said in 2007.

Buffett actually went against his own advice and bought airline stocks a few years back. He then got burnt badly in the Covid-19 stock market crash. He has since dumped all his airline stocks.

easyJet and IAG: too many things can go wrong

Aside from the capital intensive nature of the industry, another problem with airline stocks from an investment point of view is that so many things can go wrong.

For example, a spike in the oil price can impact profits negatively. Meanwhile, a terrorist attack can badly affect sentiment towards the sector and send airline stocks down sharply.

Speaking of things that can go wrong, Covid-19 could still present a challenge for companies like easyJet and IAG. A vaccine will help the industry, for sure. But it’s unlikely to be a magic bullet. In my view, it could take years for the airline industry to get back to where it was pre-Covid.

Better stocks to buy

All things considered, I’m not going to invest in easyJet or IAG shares, despite the news of the Pfizer vaccine.

These airline stocks could keep rising in the short term. However, history shows that they’re unlikely to be good long-term investments.

As a long-term investor, I think there are better stocks to buy.