Adding some international stocks to your portfolio can be a great move. Not only can they potentially boost your investment returns, but they can also help lower overall portfolio risk by diversifying your portfolio more effectively.

With that in mind, today I am going to look at the investment case for Warren Buffett’s top stock – Apple (NASDAQ: AAPL). Should UK investors follow Buffett and buy Apple shares for their portfolios?

Apple: a world-class company

There’s a lot I like about Apple. For a start, the company makes fantastic products. I’m not just talking about the iPhone. These days, Apple has a whole stable of world-class products including the iPad, the MacBook, the iMac, the Apple Watch, and AirPods. It also offers a range of excellent services including Apple Pay, Apple Music, and iCloud.

Companies that offer high-quality products and services that people love often turn out to be good investments.

Source: Apple

There’s more to Apple than just its products and services, though. You see, over the last decade or so, Apple has created an amazing ‘ecosystem’. All of its products connect to each other. This is a huge competitive advantage for the company because it creates a high level of customer loyalty.

This ecosystem is one of the key reasons Buffett has invested a fortune in Apple shares (he currently owns nearly £100bn of the stock). He’s stated in the past that one of the reasons he likes Apple is because of “the value of their ecosystem and how permanent that ecosystem could be.”

It’s this combination of world-class products and services, and the loyalty-generating ecosystem that makes Apple such a great company, in my view.

Strong growth

Apple’s financials are also very impressive. Over the last five years, revenue has climbed from $183bn to $260bn. That represents an annualised growth rate of 7.3%. Meanwhile, net profit has jumped from $39.5bn to $55.3bn. For a company of Apple’s size, that’s an impressive rate of growth.

Its profitability is high too. Over the last five years, return on capital employed (ROCE) has averaged 27%. No wonder Buffett likes the stock – a high level of profitability is one of the first things he looks for.

In terms of dividends, the yield on Apple shares is not amazing. Currently, the yield is around 0.8%. However, dividend growth has been high in recent years.

Valuation

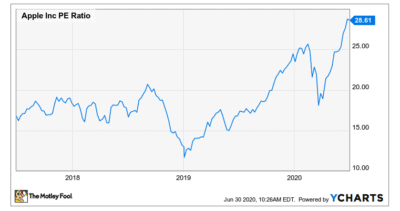

Turning to the valuation, Apple shares currently trade on a forward-looking P/E ratio of just under 30. I don’t think that’s unreasonable for a company of Apple’s quality. However, that valuation doesn’t provide a huge margin of safety. That’s important to bear in mind given the high level of economic uncertainty associated with Covid-19.

That P/E is also quite high for Apple, as you can see in the chart below.

Is Apple a good buy?

All things considered, I think Apple is a wonderful company. I believe it is a great stock for UK investors to own as part of a diversified portfolio.

That said, I’d be inclined to wait for a pullback before buying the shares. Over the last year, the stock has risen around 90%. After that kind of share price rise, I wouldn’t be surprised to see a pullback.

With a little patience, I think you might be able to pick up this world-class company at a more attractive valuation.