Early last year, I made the decision to sell my holding in Neil Woodford’s Equity Income fund after having held the fund for a little over three years. As I explained in this article, one of the main reasons I sold the fund – aside from its poor performance – was its composition. To my mind, it didn’t really resemble an equity income fund, as it held a large number of non-dividend-paying stocks.

Would I invest in it today? Looking at the portfolio and its performance, no I wouldn’t. Here’s a look at why I’m still avoiding this one.

Poor performance

Woodford’s Equity Income fund continues to underperform badly. The performance figures really are quite shocking.

For example, according to Hargreaves Lansdown, over the last year, the fund is down around 6.6%. In contrast, the FTSE All-Share index is up 7.2%. My decision to sell a little over the year ago looks to have already paid off.

Yet what’s even more worrying is the performance over three years. Over this time horizon, Woodford’s fund is down around 7.8%. By contrast, the FTSE All-Share is up around 32.8% while a number of other funds have done even better. For example, Nick Train’s UK equity fund is up 47% over the last three years. That’s a significant underperformance from Woodford.

To put this poor performance in perspective, out of the 247 funds in the Investment Association’s ‘UK Equities’ fund segment, the Woodford one was ranked 246 out of 247th for performance over the last three years. With that kind of ranking, it’s no wonder that investors are pulling their money out of the vehicle in droves.

Fund composition

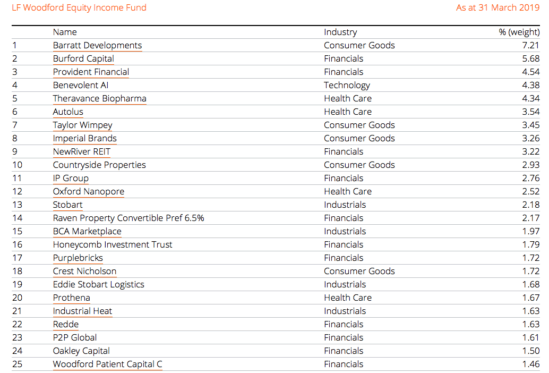

Aside from the performance of the fund, I’m still put off by the composition of the portfolio.

Last year, I noted that it contained very few blue-chip dividend stocks. Yet today, it holds even less of them. The only stock in the portfolio right now that I would classify as a blue-chip is tobacco manufacturer Imperial Brands.

Many other stocks in the portfolio are early-stage companies that are either not yet profitable or don’t pay dividends. For example, there’s Purplebricks, whose share price is down 60% in the last year. As my colleague Rupert Hargreaves pointed out recently, this is a company that may not be profitable for years, if ever. Then there are unquoted private companies such as Benevolent AI, Industrial Heat and Ombu. What these kinds of stocks are doing in an Equity Income fund I am really not sure.

Additionally, the fund has a large exposure to UK housebuilders which I think is a risky move. I would not want to be holding these stocks if Brexit resulted in a recession. Just remember what happened to the housebuilders in the Global Financial Crisis.

Source: Woodford Investment Management

While Woodford’s investment strategy could turn out to be validated in the years ahead, in my view, the portfolio looks quite risky at present. Ultimately, it’s not what I’m looking for in an equity income fund. So for now, I’ll be continuing to avoid it.