The cost-of-living crisis has had British investors on edge. I think this is the main reason why Dunelm (LSE: DNLM) shares have plunged by more than 40% this year. But after the company released its Q1 trading update today, the question is, will I be buying more Dunelm shares?

Stable legs

The retailer’s latest trading numbers were slightly disappointing. Sales figures saw an accelerated drop since the company’s last quarter. On a year-on-year basis, total sales went from a 6% fall in Q4 to a drop of 8% this quarter. Additionally, gross margins saw a 1.3% decline. However, it’s worth noting that these figures were still largely in line with analysts’ expectations, which is why Dunelm shares are largely unmoved.

That being said, I should point out that this year’s numbers are being compared to a very strong previous year. Nonetheless, when compared to pre-pandemic sales figures, Dunelm sales are actually up 36%. This shows the company’s strength, and that it can hold on to customers despite challenging times.

| Metrics/Year | Q1 (FY23) | Q1 (FY22) | Change (Y/Y) | Q1 (FY20) | Change (3Y/Y) |

|---|---|---|---|---|---|

| Total sales | £357m | £389m | -8% | £262.6m | 36% |

| Digital % of total sales | 33% | 33% | 0% | 17.6% | 15.4% |

Silver linings

There were some plus points within its gloomy sales numbers, however. For one, Dunelm said its full-year outlook remains in line with what it shared last month. This comes at a time when other retailers are downgrading guidance. The board also mentioned that it’s well hedged for its full year, despite a weaker pound.

| Metrics/Year | FY22 | FY23 outlook |

|---|---|---|

| Total sales | £1,581m | £1,553m |

| Gross margin | 51.2% | 50% |

| PBT | £209m | £174m |

Moreover, management mentioned that it continues to see robust sales across its retail channels and all categories. More importantly, it’s been seeing “a very good response” to its seasonal ranges from customers.

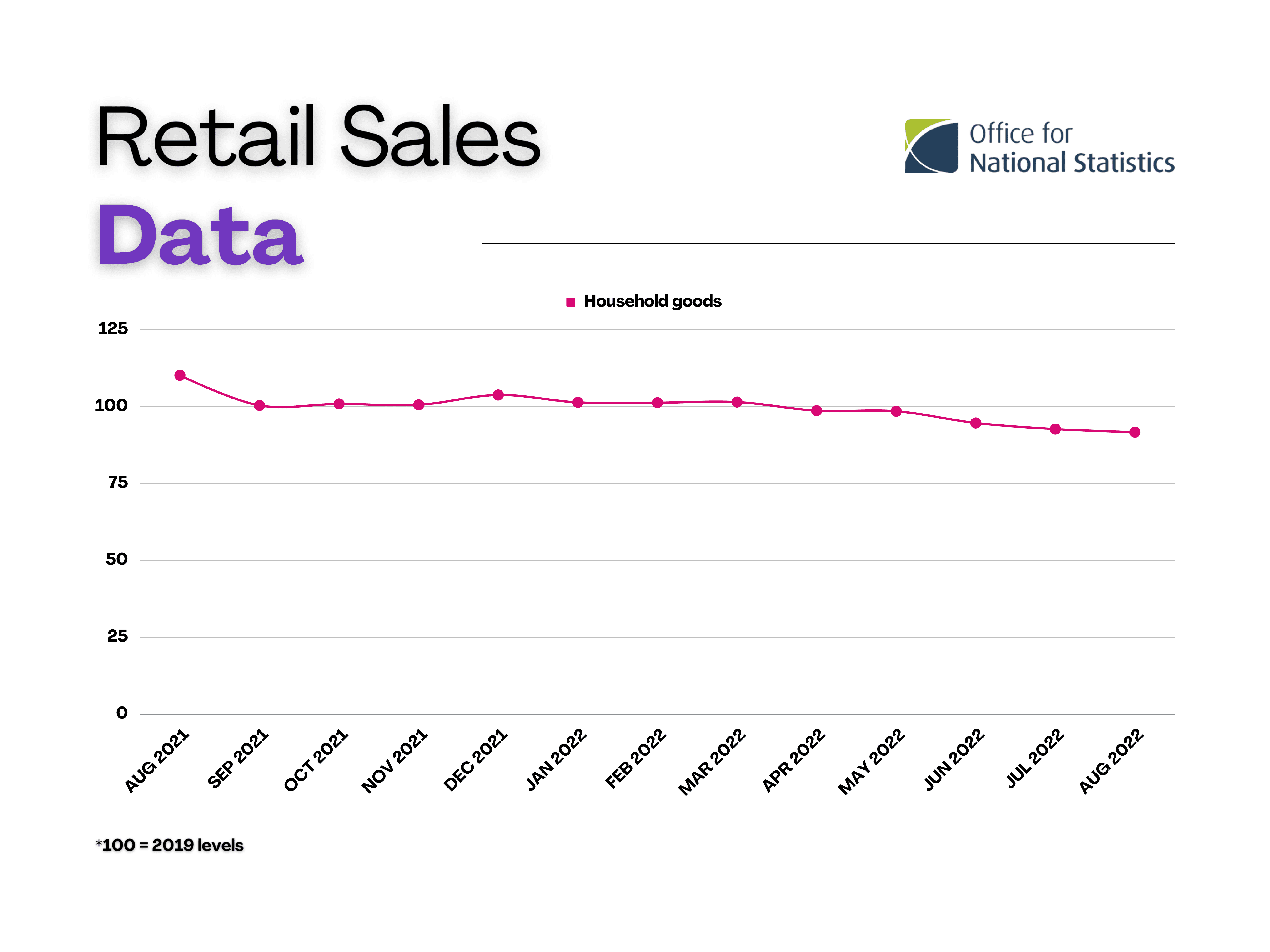

Furthermore, Dunelm’s performance has fared relatively well against the rest of the industry. There’s no doubt that the home improvement sector has taken a hit given the current recessionary backdrop. Data since April indicate that household goods stores have been underperforming 2019 levels. But when comparing these to the figures Dunelm shared, it’s safe to say that the company has been doing fairly well, given how far ahead it is of pre-pandemic levels. This supports CEO Nick Wilkinson’s view that the business is delivering good value to customers.

Planning an exit

Even so, will I be still be buying Dunelm shares? Well, the company has a decent balance sheet with a healthy debt-to-equity ratio of 29.6%, showing that it has solid foundation to weather a recession. Nevertheless, its cash and equivalents (£30.2m) aren’t sufficient to cover its debt (£52.8m), and is something worth noting.

Having said that, I’m still not convinced of its growth prospects. Given the current macroeconomic environment, Dunelm isn’t going to expand its market share by a huge margin any time soon. Its focus for now has to be on maintaining its customer base and healthy margins.

On top of that, the latest price targets from JP Morgan and Barclays indicate that Dunelm shares have limited upside too, as both banks have a price target of £7.61. I’m a buy-and-hold investor, but with its current share price at £7.89, I’m planning to exit my position and take profits before further headwinds bring its share price lower. To conclude, I believe there are better stocks in more robust industries to invest my cash in for the long term.