Earnings results are a great way for investors to judge a company. They’re used to determine whether companies are on track with their initial guidance. These results can often radically move share prices in either direction, depending on the numbers reported. So, here’s an earnings preview for three FTSE firms reporting results this week.

Analysts in the UK don’t always publish earnings previews for quarterly or half-year periods. Therefore, the upcoming figures can only serve as an indication as to whether the companies’ full-year forecasts can be met.

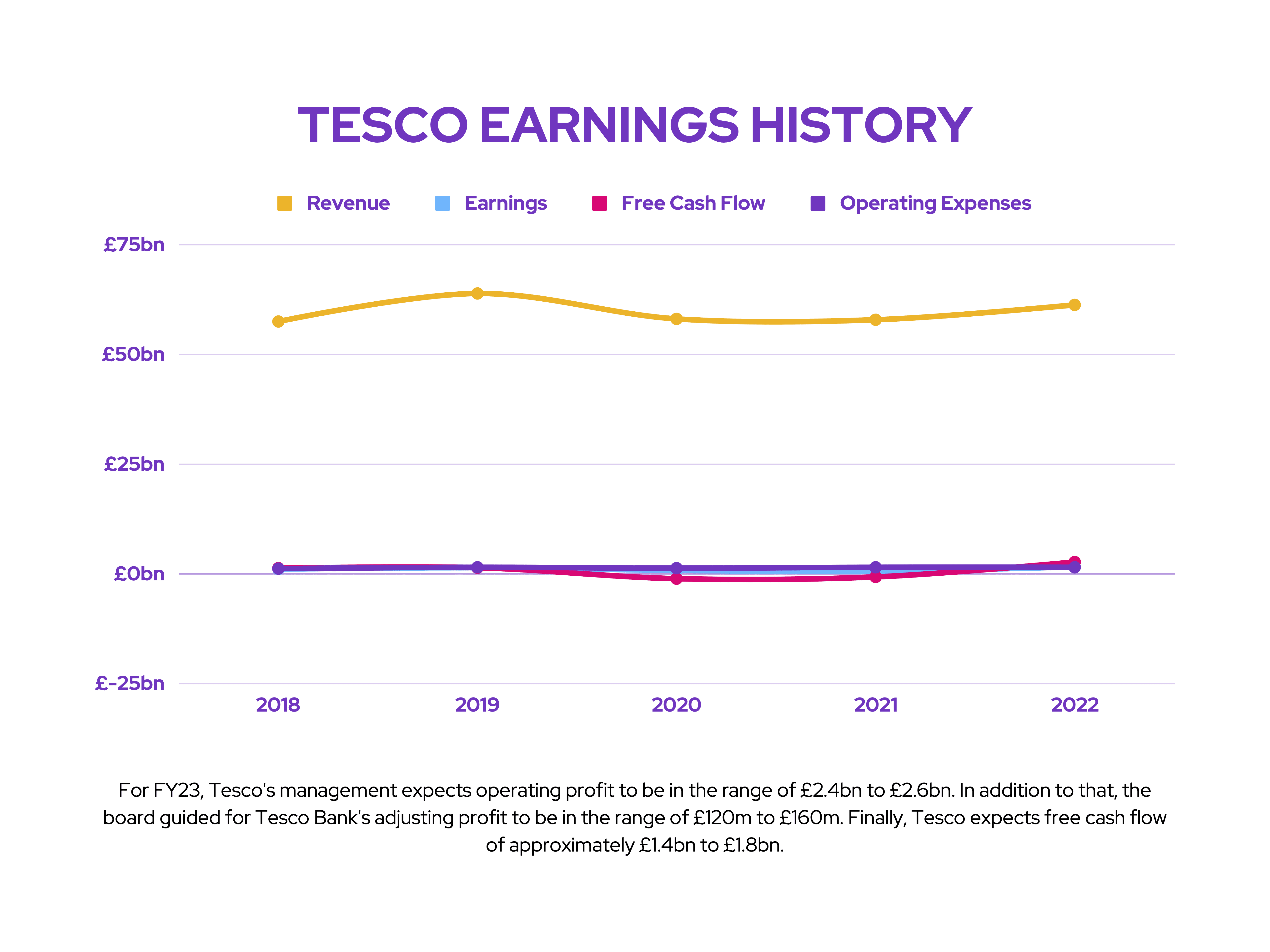

Tesco (H1 earnings)

Tesco (LSE: TSCO) is the UK’s biggest supermarket. Apart from selling groceries, the retailer also has businesses in fuel, banking services, and mobile phone plans. It also has operations in several European countries. Tesco is set to reveal its H1 numbers for its six months performance ending August on 5 October.

The earnings preview for the FTSE 100 giant indicates a decline in the bottom line number for its full-year forecast. This is most likely due to the worsening cost-of-living crisis that will undoubtedly impact margins.

Excluding fuel, overall revenue saw a year-on-year decline in Q1. With fuel prices cooling since the last quarter and discounted grocers such as Aldi and Lidl taking market share, Tesco may see negative growth in this half. As such, expectations for earnings numbers on Wednesday are relatively modest. Tesco will have to surprise investors with better-than-expected numbers and margins for its share price to see any respite to its recent decline given the current market climate. This is unlikely to happen, so the supermarket will have to announce something revolutionary to sway investor sentiment.

| Metrics | Amount (H1 2022) | Amount (FY22) | Analysts Earnings Estimates (FY23) |

|---|---|---|---|

| Total Revenue | £27.33bn | £63.5bn | £63.63bn |

| Adjusted Diluted Earnings per Share (EPS) | 11.22p | 21.86p | 20.87p |

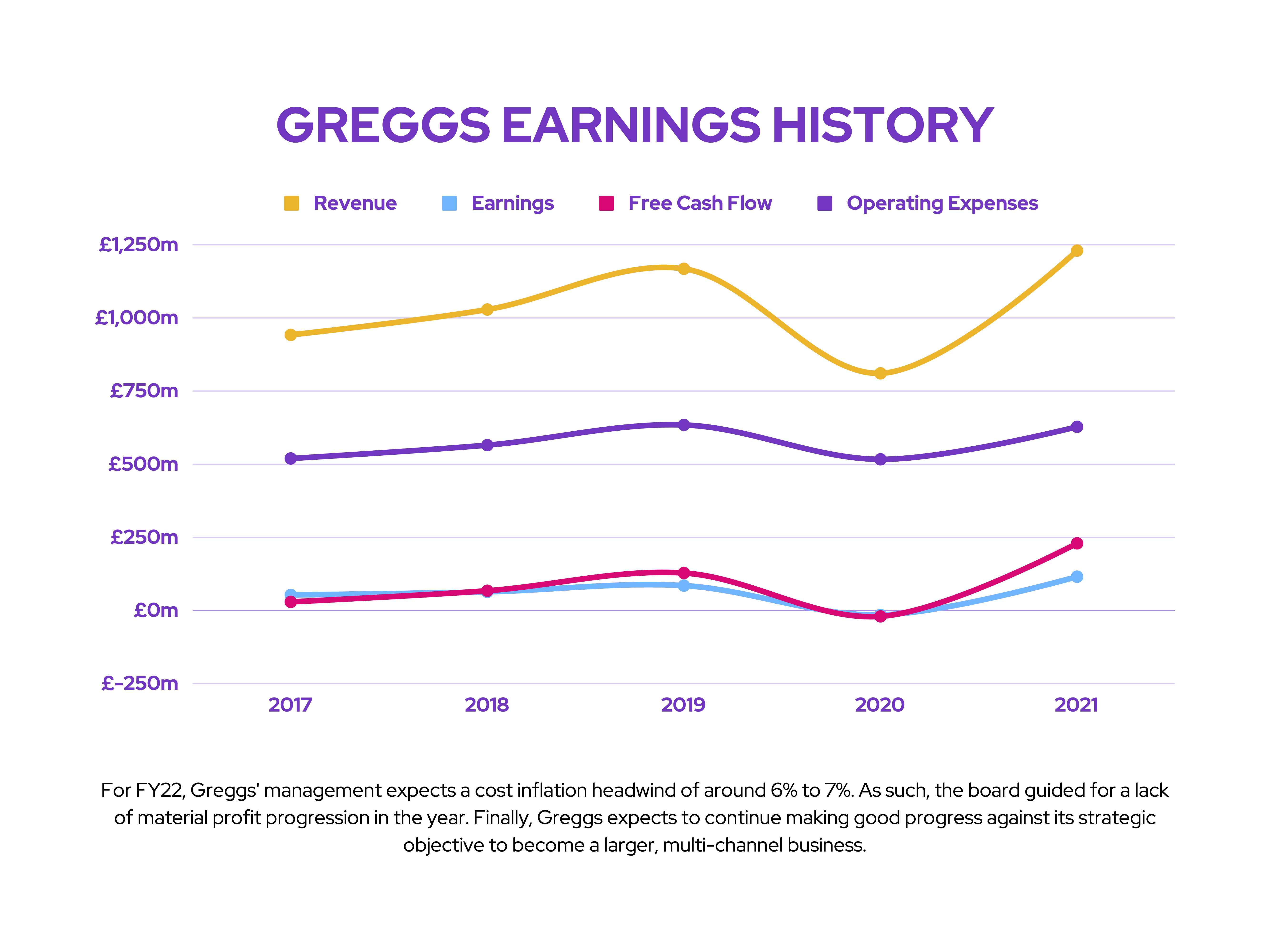

Greggs (Q3 trading update)

Greggs (LSE: GRG) is a British bakery chain. The bakery is best known for its savoury products such as bakes, sausage rolls, sandwiches, and for sweet items that include doughnuts and vanilla slices. The Newcastle-based firm is expected to unveil its Q3 numbers for its three months performance ending September on 4 October.

Greggs doesn’t disclose revenue or earnings figures for its quarterly updates, so a direct comparison can’t be drawn this October. Rather, the pastry maker discloses metrics such as like-for-like sales and shops opened, which are useful indicators too. These can serve as an earnings preview for investors to determine whether the FTSE firm is on track to hit its ambitious growth targets by the end of the year.

Throughout the year, Greggs has acknowledged the impact of price pressures. Because of this, the board’s expectations for the full-year outcome remain unchanged as they do not expect material profit progression in the year ahead. That being said, investors will definitely be paying close attention to the outlook on Tuesday. Any downward revisions to earnings expectations could see the Greggs share price drop further as investor sentiment remains fragile after the most recent market turmoil last week.

| Metrics | Amount (FY21) | Analysts Earnings Estimates (FY22) |

|---|---|---|

| Total Revenue | £1.23bn | £1.42bn |

| Diluted Earnings per Share (EPS) | 114.3p | 117.4p |

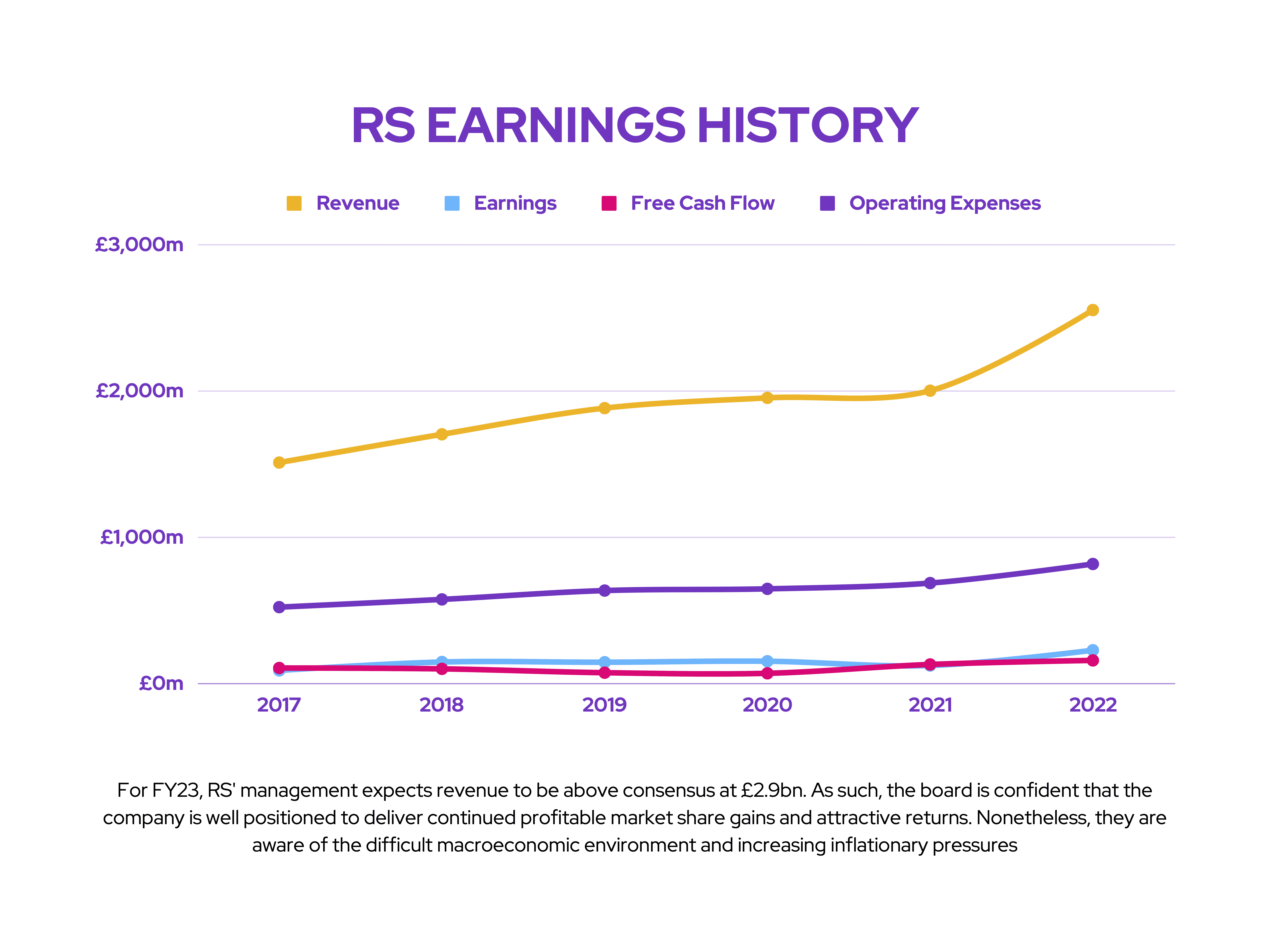

RS (Q2 trading update)

RS (LSE: RS1) is a distributor of industrial and electronics products. Formerly known as Electrocomponents, the FTSE 100 company provides product and service solutions for designers, builders, and maintainers of industrial equipment and operations. RS is scheduled to report its Q2 numbers for its three months performance ending September on 6 October.

The distributor is only expected to release its full set of figures in its H1 earnings report on 3 November. For that reason, the upcoming trading update serves as an earnings preview for investors to get a couple of hints as to whether the FTSE company had a good first six months, and whether it’s able to hit analysts earnings estimates for the year ahead.

| Metrics | Amount (H1 2022) | Amount (FY22) | Analysts Earnings Estimates (FY23) |

|---|---|---|---|

| Total Revenue | £1.20bn | £2.55bn | £2.84bn |

| Adjusted Basic Earnings per Share (EPS) | 21.5p | 48.9p | 57.4p |