I’m searching for the best high-dividend UK shares to buy for my portfolio. So should I buy one, both, or neither of these FTSE 100 income stocks? Both carry mighty dividend yields north of 10%.

NatWest Group

Of all the FTSE 100’s banks, NatWest Group (LSE: NWG) offers the greatest yield. For 2022, it boasts a monster 11.8% dividend yield, more than twice that of Lloyds, another popular income stock.

In fact, the business offers excellent all-round value on paper. As well as that huge yield, it trades on a forward price-to-earnings (P/E) ratio of 7.4 times.

Earnings have popped at NatWest in 2022 thanks to rising interest rates. A subsequent rise in what it charged borrowers in the first half of the year powered pre-tax profit 13% higher year on year, to £2.6bn.

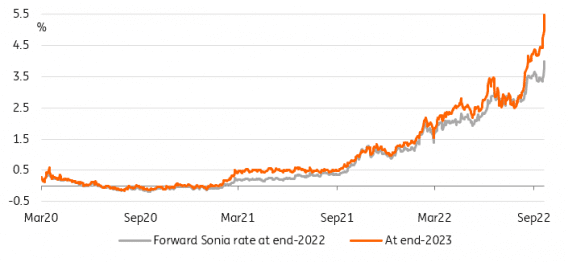

The good news is that interest rates are tipped to continue climbing rapidly, too. In fact analysts at ING Bank say they could now soar above 5% in 2023 due to the measures announced in Friday’s ‘mini budget’.

But this is not enough to make me invest in NatWest shares today. Britain’s economy is facing a period of painful contraction in the near term and low growth thereafter. So banking stocks like this face the prospect of soaring bad loans over the next couple of years and weak revenues thereafter.

I’m not averse to buying banking stocks as the global economy toils. However, I’d prefer to invest in ones with exposure to fast-growing economies like Asia-focused HSBC or Standard Chartered. I think they’d be better buys for long-term growth.

Persimmon

On the other side of the coin, Persimmon (LSE: PSN) is a UK high-dividend share which is in danger of losing out from higher interest rates.

Recent action by the Bank of England means that the cost of owning a mortgage is rising sharply. And if those ING projections prove correct and interest rates more than double from current levels of 2.25%, demand for homes could fall sharply.

I’m still backing Persimmon and other homebuilders to continue thriving, however. This is why I actually bought the FTSE 100 share for my own portfolio during the summer.

I’m optimistic because I’m expecting demand for newbuild homes to keep outstripping demand even as rates rise. The government’s decision to cut stamp duty in last week’s mini budget could also help mitigate the impact of higher interest rates.

Most forecasters suggest that Britain needs to create more than 300,000 new homes every year to keep up with demand. Yet with government housing policy still to get off the ground the shortage of new homes is worsening. This suggests to me that property prices should continue rising for some time yet.

Persimmon trades on a forward P/E ratio of 5.5 times. And it carries an enormous 16.3% dividend yield, too. At current prices I believe it remains too cheap to miss.