Following a rather upbeat set of first-half results earlier this month, the Deliveroo (LSE: ROO) share price saw a 7% pop. Since then, the stock has slid and is now down 15% in just one week. So, could this be a bargain buy for my portfolio or a value trap I should avoid?

Stuck in traffic

Deliveroo’s H1 results were a bit of a mixed bag. There was a modest increase in revenue, along with other metrics such as gross transaction value (GTV), orders, gross profit, etc. Meanwhile, other metrics such as GTV per order, monthly order frequency, and adjusted EBITDA saw declines.

| Metric | H1 2022 | H1 2021 | Change |

|---|---|---|---|

| GTV | £3.56bn | £3.33bn | 7% |

| GTV per Order | £22.10 | £22.70 | -3% |

| Revenue | £1.01bn | £907m | 12% |

| Take Rate | 28.5% | 27.3% | 1.2% |

| Total Orders | 161m | 146m | 10% |

| Monthly Active Customers | 7.8m | 7.6m | 4% |

| Monthly Order Frequency | 3.3 | 3.4 | -3% |

| Adjusted EBITDA | -£68m | -£26m | -163% |

At first glance, I don’t like the slow down in growth, given that Deliveroo is meant to be a growth stock. However, I can forgive the deceleration when I take the wider context into account. The firm faces tough comparisons against last year’s results, which were helped by the pandemic. Additionally, high inflation is eating away at consumers’ disposable income, leading to a reduction in discretionary spending. Nonetheless, CEO Will Shu did point out that order frequency remained above pre-pandemic levels.

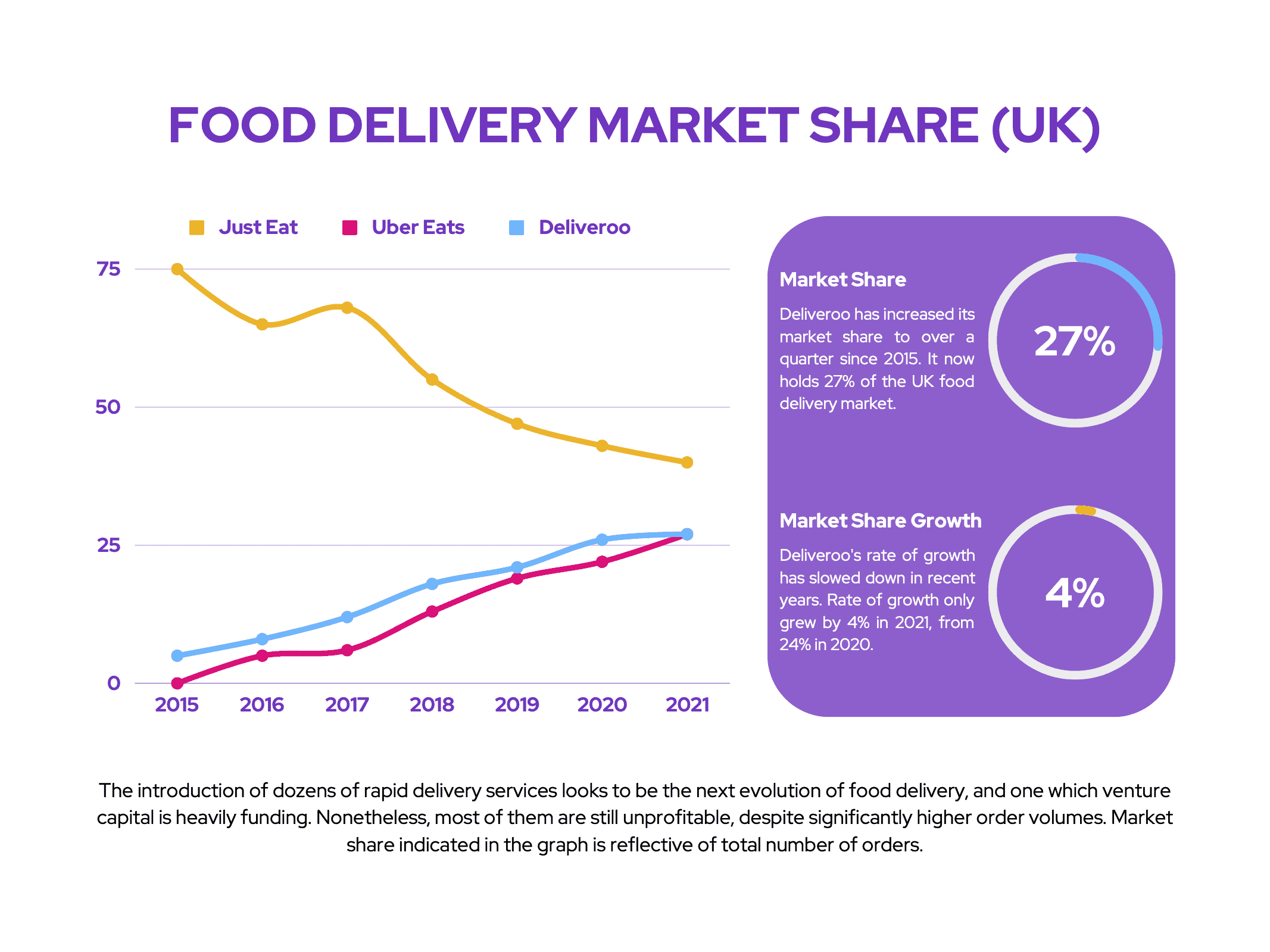

Despite worries about the company potentially losing market share due to the slow down in growth, management stressed on the earnings call that they continue to expect Deliveroo to capture more customers in the UK and EU.

Diverse Deliveroo

Part of the reason for Deliveroo’s success in gaining market share can be attributed to its diverse streams of revenue. Aside from delivering food from restaurants, Deliveroo has branched out to groceries and other non-food items, and formed partnerships with many grocery and essential stores. These include the likes of Sainsbury’s, Carrefour, WHSmith, and many more. The effects of these partnerships were reflected in the company’s grocery GTV, which increased as a percentage of total GTV.

Moreover, Deliveroo recently signed a deal with McDonald’s, with the effect of its rollout still yet to be reflected in the numbers. It’s also expanded its Amazon partnership to Italy, France, and UAE, which should see more Deliveroo Plus members, and more orders as a result. I’m expecting these catalysts to allow the delivery service to continue growing its market share locally and internationally.

Furthermore, Deliveroo opted to further diversify its revenue stream with the introduction of an advertising platform. It plans to allow brands to target its customers through the app, as well as social media, e-mail, and via push notifications. Management expects advertising to become a substantial part of its revenue mix. If successful, this could push Deliveroo into profitability at a much quicker pace.

Riding towards profitability?

All in all, the board still maintains its guidance to achieve EBITDA breakeven by mid-2023 to mid-2024. They expect to execute this through better cost control and more efficient marketing spending. And this can already be seen through its exit from the Dutch and Spanish markets, which provided little return on investment.

| Metric | FY23 Outlook | Change |

|---|---|---|

| GTV Growth | 4% to 12% | -58% to -62% |

| Adjusted EBITDA | -1.5% to -1.8% of GTV | 0.2% to 0.5% |

With a solid balance sheet of £1.13bn and zero debt, Deliveroo should have sufficient capital to runs its business until it achieves profitability. Even so, food delivery companies are notorious for being unprofitable. Therefore, despite a lucrative upside and an average price target of £1.31, I’m not inclined to buy Deliveroo shares given the company’s unproven business model.