After a prolonged period of contraction, FTSE stock Vodafone (LSE: VOD) is growing again, its dividend yield is more than 6.0%. So the question is should I buy it?

Vodafone is a stock that’s fallen on hard times, but that could all be about to change thanks to price rises, new services and increasing customer numbers.

This is a combination that’s driving a turnaround at the group, and one that isn’t reflected in its share price in my opinion.

Growth strategy

Vodafone was once a giant among the FTSE constituents; however, these days it’s a more modest concern with a market cap of £32.5bn. Having been through a period of contraction, the stage looks set for Vodafone to start growing once more.

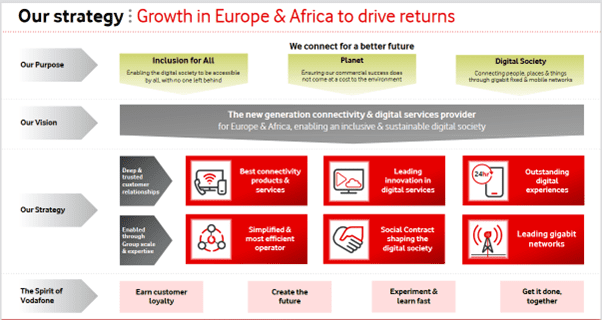

In its first-quarter update, published in late July, Vodafone outlined its growth strategy for Europe and Africa, its principal markets. The firm’s goal is to grow through service, simplicity, experience and innovation.

That strategy seems to be working, as it’s grown in Europe and Africa over the last five quarters.

Growth in Africa, where Vodafone has almost 50m users, outstrips that seen in Europe. However, service revenues in Turkey grew by almost 36% during the first quarter of the financial year 2023, with Egypt growing by 19.5% over the same period.

UK service revenue growth rose by 6.5% in Q1, and the number of UK and European mobile customers in a contract with Vodafone also grew sharply, up by 215,000.

What’s more, unlimited mobile plans are driving higher average revenue per user numbers, meaning that Vodafone is adding new customers and earning more out of them.

Future potential

Vodafone has an eye on the future, and it has amassed 25.5m European broadband customers and almost 22m TV subscribers.

It offers high-speed 5G networks in 318 European towns and cities, and some 159m devices connect to the internet of things via a Vodafone SIM card.

Vodafone also retains an 81% stake in Vantage Towers, one of Europe’s leading cellular infrastructure companies, a sector that has seen M&A activity.

The stock has a current dividend yield of 6.26% — that’s almost twice the current average for the FTSE 100. It has paid dividends since 1991, giving it a 30-year track record of rewarding shareholders.

As with the market cap and share price, the dividend is lower than it once was, but there is no reason that it can’t grow in line with the wider business.

Of course, being consumer-focused, Vodafone is sensitive to variations in household spending, which high rates of inflation and rapidly rising utility bills may temper over the next six months.

However, I think we can assume that most customers will be very reluctant to give up their mobile devices and connectivity.

Vodafone’s recovery potential and dividend yield make it an attractive proposition, and one that will be on my watchlist of possible buys well into the autumn.