Investing in iShares UK Dividend UCITS ETF (LSE: IUKD) is a great way for me to generate passive income for retirement. This exchange traded fund provides diversified exposure to the higher-yielding sub-set of the FTSE 350 index. The ETF aims to invest in 50 UK companies with a focus on income.

Benefits

The fund has a 12-month trailing yield of 6.41%, which is above the current FTSE 100 yield of 3.67%. The fund pays dividends on a quarterly basis, which is ideal during retirement. As the fund invests in 50 different companies, it provides better portfolio diversification than investing in a single 6%+ dividend stock.

The fund is managed by BlackRock, which is one of the largest asset managers in the world. BlackRock is known for providing better liquidity than other asset managers due to higher trading volume in its ETFs. This ensures that I am able to cash out more easily during stress or at retirement.

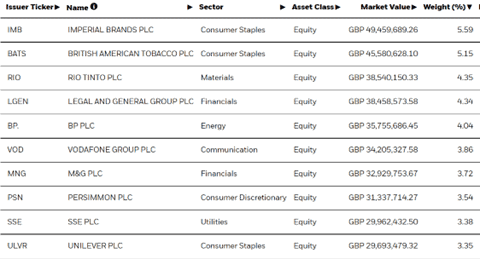

The top 10 largest holdings in the fund include popular FTSE 100 stocks such as the tobacco company Imperial Brands or the asset manager Legal & General. The full list of holdings is available on the BlackRock website.

In the current inflationary environment, I believe that dividend shares remain the best hedge against inflation. Inflation can lead to higher profits and dividends if companies are able to protect their margins by passing on costs to consumers through price rises.

As the rate-hiking cycles continue globally, I believe investors will search for value and short growth stocks. High-yielding stocks are great sources of value during inflationary periods; hence the fund could benefit from capital appreciation.

Risks

Firstly, the fund is particularly exposed to ‘Financials’ and ‘Consumer Staples’, which represent nearly 50% of the fund’s market value. The Consumer Staples category refers to essential products used by consumers, which includes alcohol and tobacco.

The top two holdings of the fund are Imperial Brands and British American Tobacco. From an ESG point of view, the fund might not be the best investment for all investors.

Secondly, the fund is 100% invested in the UK, which provides no geographical diversification. As the UK is forecasted to go in recession later this year, it is important to be aware of the macroeconomic risks faced by the UK.

Conclusion

Overall, UK iShares Dividend UCITS ETF offers an above-average dividend yield and strong portfolio diversification. The fund is a great way for me to generate passive income during retirement.