I know, I know. After the Twitter debacle, it can be hard to take some things seriously that Elon Musk says about investing these days. So can I take his recent talk about lithium shares seriously?

He was quoted (tweeted?!) bemoaning the high lithium price and the cost impact on his Tesla car production. He went on to encourage entrepreneurs to invest in the “printing money business of lithium mining”.

Now, owning shares in a money-printing machine sounds awesome. But is it really a good time for me to buy any of the top lithium shares?

Why have lithium shares skyrocketed?

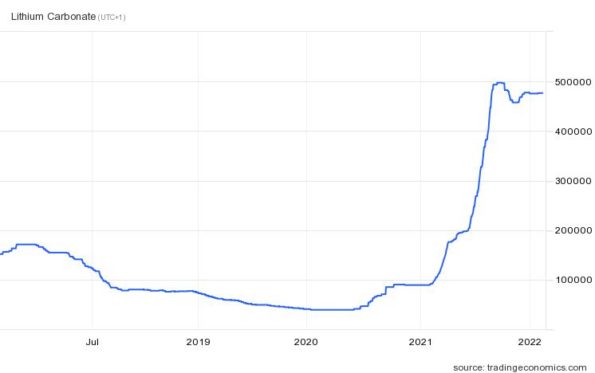

I can easily understand where Musk is coming from with his comments. Underlying lithium prices have skyrocketed by 600% this year, driving (pun intended) a 20% price rise for Tesla cars.

That price rise is not going to make it any easier to sell a luxury product into a likely upcoming recession. Hence Musk’s encouragement for more investment.

Potential investors may be further encouraged by seeing rocketing share prices of existing lithium companies. Take Atlantic Lithium (LSE: ALL) for example. It’s up over 75% in the last year alone, despite its recent falls.

Atlantic, along with others, has benefited from that eye-watering price rise, driven by demand vastly outweighing supply.

But can that meteoric rise really continue?

Where’s next for lithium share prices?

There’s a split of opinion (as ever) in terms of where next for lithium share prices. Largely driven by the supply/demand balance for the material, a lot hangs on the timing of new supplies.

On the one side – perhaps unsurprisingly – are the lithium miners. They’re confidently pointing to expected demand growth of electric vehicles continuing to rise rapidly.

But both CitiGroup and Goldman Sachs see extra supply coming through in the next couple of years, which will meet that demand.

Goldman stated: “We forecast all three metals to shift into sustained surplus over the next 1-2 years, which means materially lower price levels, in our view.“

Long-term though, despite tight budgets, it’s hard to see governments turning away from supporting the push for electric cars. So, as a long-term investor, I can see a case for lithium exposure in my portfolio.

Yet are higher-risk small lithium mining shares really my only choice for that?

Spreading the lithium price risk

Before I retired early, one of my many hats was as an energy risk manager. It’s second nature to me to want to diversify.

That’s why I’d prefer to buy Rio Tinto (LSE: RIO) shares than pure lithium miners. As a global mining giant, Rio has both the balance sheet and mining experience that could see it become a major player in this space. Especially if it can sort out the political wrangling over its new lithium mine in Jadar.

Best though is its natural diversification across other commodities. That makes it a less risky way for me to invest in lithium mining. The roughly 10% dividend yield doesn’t hurt either.

It’s also fallen almost 20% over the last year. That means I don’t feel like I’m buying at the top of the market.

It may not satisfy Elon Musk’s immediate demand, but as a long-term play it’s one I’m far happier to hold.