I’ve been scouring the FTSE for the best dividend stocks to buy. And I think Glencore (LSE: GLEN) has the perfect recipe to deliver long-term passive income.

Record profits

The mining business posted record half-year profits in the six months to June. These were delivered on the back of high commodity prices as worries over supplies intensified.

Looking ahead, the company faces significant uncertainty as the global economy cools. Indeed, China’s announcement last week that it might miss its growth targets is a particular concern. The country’s vast manufacturing sector makes it a critical driver of commodity prices.

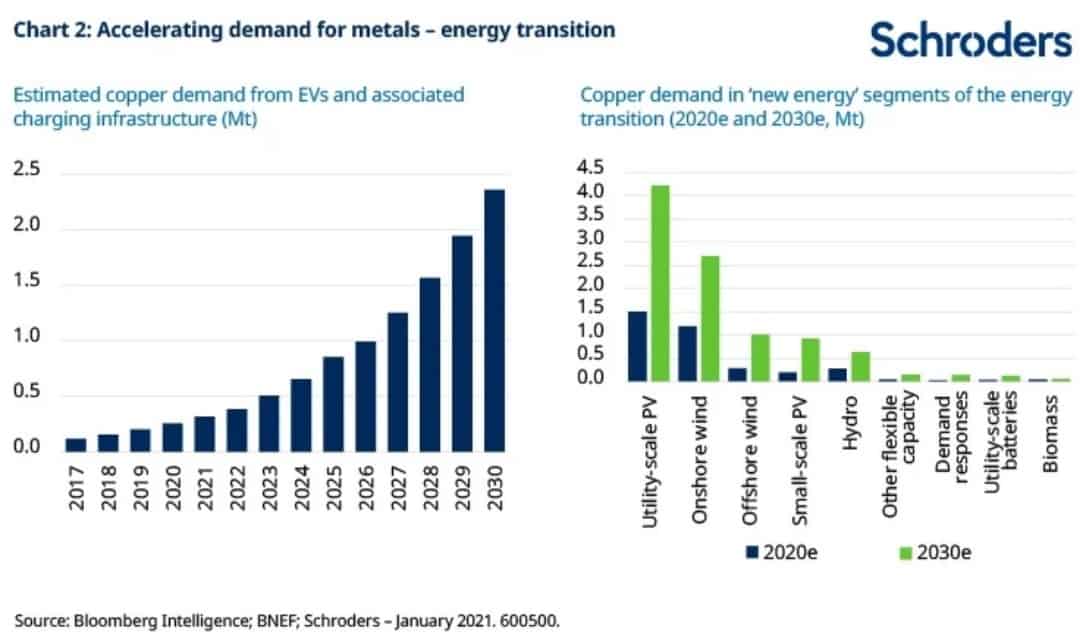

Still, I believe that Glencore is a top share to own for the next several years. You see, the world is on the brink of another commodities supercycle, driven by increasing urbanisation in emerging markets; rising demand for consumer electronics; and the growing popularity of green technology (think electric cars and wind turbines, for example).

Dual roles

I think Glencore in particular is a great way to capitalise on the commodities boom.

The company is a major producer of metals including copper, nickel, zinc and lead. But the business also has a huge marketing operation from which it sells, transports, processes and stores physical commodities from its global supplier base.

This gives Glencore an advantage over most other commodities stocks. Mining is an industry that’s packed with risk. Exploring for minerals can often yield disappointing results, shattering a company’s long-term profits outlook. Problems at the mine development and production stage, meanwhile can drive costs through the roof and ruin revenues forecasts.

Profiting from volatility

But reducing Glencore’s reliance on the unpredictable business of digging for metals isn’t the only advantage. It also allows the FTSE 100 firm to capitalise on periods of market volatility.

And it means that Glencore can generate decent profits even when commodity prices are down. As analysts at Hargreaves Lansdown point out: “Performance relies more on volatility in the market than whether prices are high or low.”

A top dividend stock

| Share price | 466.8p |

| Price movement in 2022 | +23% |

| Market cap | £60.2bn |

| Forward price-to-earnings (P/E) ratio | 4 times |

| Forward dividend yield | 11.4% |

| Dividend cover | 2.2 times |

So Glencore’s a great stock to hold until the end of the decade, then. But I also said it’s a particularly brilliant dividend share to own. So let’s drill down more into that now.

First of all, the company’s yield for 2022 sits firmly in double-digit territory. It is also more than three times larger than the FTSE forward average of 3.7%.

Secondly, this year’s predicted dividend is covered more than two times by anticipated earnings. This metric suggests there’s a great chance Glencore will meet broker forecasts.

And finally, Glencore has a rock-solid balance sheet to help it pay that big dividend. This is underlined by its decision last week to return an extra $4.5bn to shareholders. It will do this by awarding a special dividend and launching a share buyback programme.