I’ve closely monitored developments since GSK (LSE: GSK) separated from Haleon (LSE: HLN) last month. Haleon shares have fallen 6% following their stock market debut a fortnight ago. The new company is now the world’s largest consumer health business with a market cap of £26.58bn and a place in the FTSE 100 index.

Meanwhile, the former GlaxoSmithKline has rebranded as GSK — a growth stock prioritising R&D and commercial investment in vaccines and speciality medicines. The GSK share price has remained largely flat after an initial 19% crash when the spin-off was announced.

Let’s explore which stock I’d buy in August.

Haleon

Haleon owns a range of household brands, including Sensodyne toothpaste and Panadol painkillers. It operates in over 100 markets worldwide. The firm will benefit from leadership continuity with Brian McNamara remaining at the helm after having run the unit when it was still part of Glaxo.

Revenue for Q1 FY22 was £2.62bn, up from £2.3bn a year ago. In addition, the company delivered an impressive 4.4% compound annual growth rate in sales from 2019 to 2021. It expects growth will remain in a 4%-6% range this year.

Pfizer recently announced plans to divest its entire 32% stake from November. This makes Haleon a key takeover target. If the business thrives, I believe an acquisition could be good news for shareholders who would stand to benefit. However, there’s a risk it might struggle and a takeover could occur while the valuation is depressed.

Indeed, Haleon has a lot to live up to. GSK rejected a £50bn offer for the business from Unilever earlier this year — well above its £30.5bn market cap on the first day of trading. It also inherited a £10bn debt burden from GSK. This could be a headwind for the Haleon share price if it fails to achieve its debt reduction goals.

GSK

GSK is now a pure biotech stock. Newly approved HIV treatments and a promising pipeline of oncology drugs are both strings to GSK’s bow.

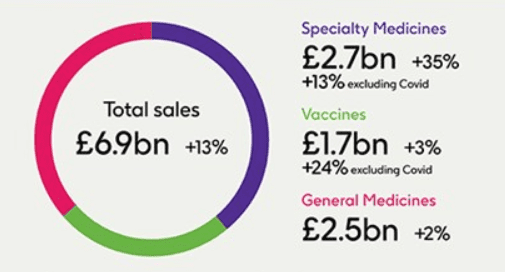

In addition, the FTSE 100 pharma giant recently raised revenue and profit guidance following record sales of its shingles vaccine, Shingrix, which more than doubled to £731m. What’s more, in Q2 FY22 the business delivered revenue growth across all three divisions.

I find the stock’s price-to-earnings ratio of 13.36 appealing. It’s considerably lower than those of competitors AstraZeneca. At the current level of £17.28 per share, I can certainly see the case for GSK as a value investment proposition.

However, I have concerns that due to its separation from Haleon, GSK has lost a highly cash-generative part of its business. The company anticipates it will slash its dividend to 45p per share for 2023 from the 80p per share it has distributed over the past five years.

Which stock should I buy?

Although Haleon shows promise as an individual business, it’s too early for me to invest at present. I’d like to see some concrete financial results and cuts in the debt balance before I buy.

On the other hand, I would buy GSK shares today. While the company may not continue to offer big dividend payments, I’m excited by the new focus on growth opportunities and the potential for capital appreciation.