I’m always on the lookout for oversold FTSE 100 stocks. After a solid performance so far this year, a sharp downturn in National Grid (LSE: NG) shares last month caught my eye.

A recent announcement that the utility company will undertake its biggest network upgrade since the 1960s has eased some selling pressure. Is this the start of a sustained rebound in the National Grid share price and should I buy the stock today? Let’s explore.

Renewables

After selling a 60% stake in its gas transmission unit earlier this year, National Grid is cementing its position as a top renewable energy stock. Indeed, the company avoided the windfall tax levied on oil and gas companies, such as BP and Shell.

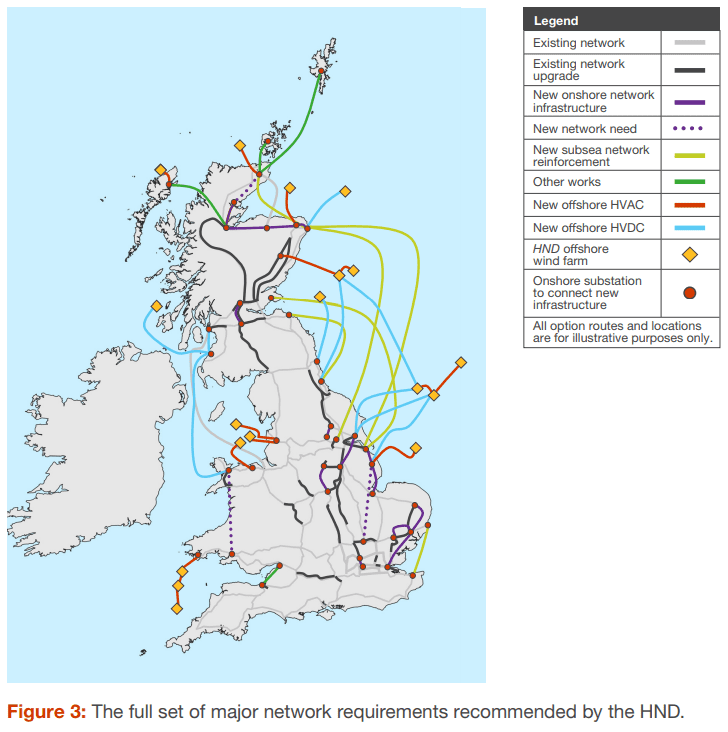

News of a £54bn investment package to connect new offshore wind farms to the grid helped reverse the stock’s downtrend. The project, which is part of the group’s holistic network design for net zero, is expected to reduce CO₂ emissions by 2 mega tonnes between 2030 and 2032.

I consider clean energy stocks to be good long-run investments for my portfolio as evolving environmental regulations are increasingly likely to favour these businesses. The growing trend towards ESG investing on the part of retail and institutional investors alike is another bullish factor for National Grid shares, in my view.

Admittedly, the electricity supplier will have to navigate lengthy public consultations to deliver its planned infrastructure developments. The significant capital required could also hurt profits.

Nonetheless, I see this as a price worth paying to ensure the company is at the forefront of providing solutions to the 21st Century’s energy challenges, and in turn offering shareholders an attractive business model for the future.

Mixed financials

The company’s financial position is a mixed bag for me. Operating profit for FY22 was up 11% and underlying earnings per share also grew by 10%. The business performed well on both sides of the Atlantic, posting profit increases in the UK and in New England.

However, I’m not too excited about the utility stock’s price-to-earnings ratio of 18. The dividend yield looks more promising at first glance. At 4.67%, this comfortably beats the FTSE 100 average. Yet I’m concerned that the company is supporting its dividends with debt.

Given it’s an asset-heavy business, net debt is high. This figure was £42.8bn by the end of March 2022. But National Grid has projected it will fall by £3bn this financial year, I worry that the debt burden could weigh on the share price going forward.

Should I buy National Grid shares?

The long-run prospects for the company look encouraging to me. Renewables are likely to play an increasingly crucial role in the country’s energy infrastructure. National Grid’s wind power plans should allow the company to capitalise on this trend.

However, I’m not sure there will be a sustained rebound for the stock until debt is under control and dividends are paid entirely from free cash flow. Accordingly, I think there could be better buying opportunities ahead.

I won’t be buying today, but I’ll closely monitor the company’s performance and it remains high up on my watchlist.