It’s been a rough ride for Scottish Mortgage Investment Trust (LSE: SMT) shares in 2022. A plummeting US tech sector means the FTSE 100 stock has lost a whopping 37% of its value since 1 January.

However, things have been more cheery for Scottish Mortgage shares of late. They’ve risen around a fifth in value during the past month and just hit their most expensive since early May.

Can the Scottish Mortgage share price continue its recovery? And should I buy the investment trust for my own portfolio today?

So what’s happened?

As I say, Scottish Mortgage shares have fallen sharply in 2022 as tech stocks melted. The investment trust has high exposure to US and Chinese technology companies including Tesla, Amazon and Alibaba.

As market confidence has plummeted in 2022 selling of these stocks has intensified. Shares like these are more sensitive to broader economic conditions, as a swathe of disappointing trading updates from the tech sector have shown.

What’s more, tech stocks also tend to command sky-high valuations. Their elevated prices reflect investor expectations of breakneck profits growth. Expensive shares like these therefore have a habit of being the most heavily sold when risk aversion surges and these earnings forecasts start to come under question.

Bargain hunters

However, more recently tech stocks have bounced back a bit as dip buyers have emerged. This includes a large number of businesses that Scottish Mortgage is invested in.

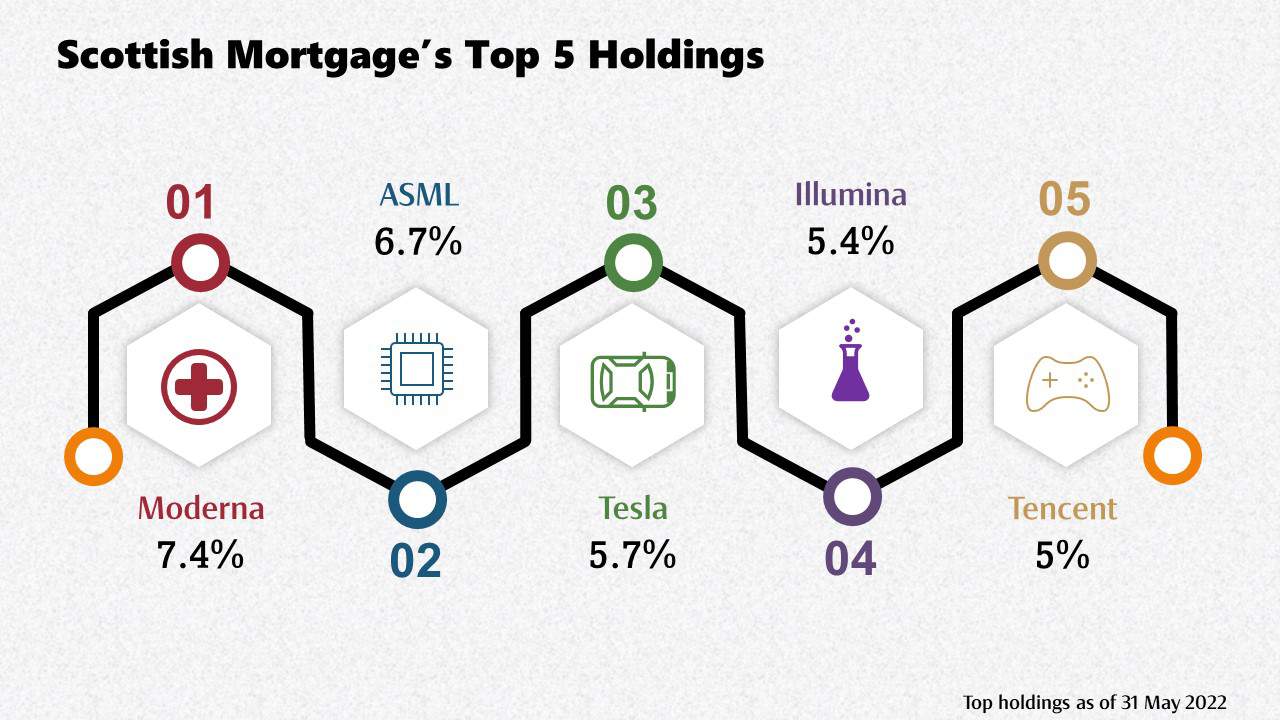

Take Moderna for instance, Scottish Mortgage’s number one holding. It’s risen almost 25% in value during the past month, pulling the investment trust higher again in the process.

Scottish Mortgage itself still looks quite cheap when you look at its share price versus its net asset value (NAV). At 850p per share, the trust trades at a discount of 7.3% to the value of its underlying assets.

Too high-risk?

There seems to be scope for Scottish Mortgage’s share price to keep rising then. But confidence on stock markets remains exceptionally fragile and I wouldn’t bet against it falling again.

Key inflation gauges continue to shock and central banks are aggressively hiking rates in response. Both of these threaten to choke off the post-pandemic economic recovery. At the same time, Covid-19 cases in China are rising again and pose a significant threat to the tech sector.

What’s more, some of those names in the investment trust’s portfolio continue to trade on stratospheric price-to-earnings (P/E) multiples. So they remain super vulnerable to further bouts of heavy selling.

Tesla, for instance, trades on a forward P/E ratio of around 68 times, while Amazon’s multiple sits at an enormous 244 times.

The verdict

Scottish Mortgage has a terrific long-term record of share price growth. Over the past five years it’s risen 111% in value as the tech sector continued to take off.

But lingering concerns over the macroeconomic landscape — and whether the tech sector is in a state of slow implosion — means I won’t buy Scottish Mortgage shares right now.