The Alphabet (NASDAQ: GOOGL) share price just ‘lost’ 95% of its value today. The stock was trading above the $2,200 mark on Friday but is now trading just above $110. Here’s why, and whether I’ll be buying Alphabet stock for my portfolio.

Heading Dow-wards?

The sole reason for the drop in the Alphabet share price is its recent 20-to-1 stock split. Those who held the stock when the US market closed on Friday were awarded 19 additional stocks for every stock they held. The value of each stock has been divided by 20 as well.

According to the board, the reason for this split is to encourage higher trading volume while making access to Alphabet stocks easier. However, this is a double-edged sword. While a ‘cheaper’ stock encourages more volume to boost its share price, it also means that it’s more vulnerable to being shorted and driving the share price down. This is a genuine risk considering the negative sentiment surrounding the current bear market.

Nonetheless, the main prospect from the stock split is Alphabet’s potential entry into the coveted Dow Jones index. The index includes 30 of the most prominent companies listed on US stock exchanges. Given Alphabet’s prominence, analysts are predicting it’s a matter of when and not if the NASDAQ-listed firm gets inducted. If this happens, I expect the Alphabet share price to rally, as institutions tracking the index will have to purchase the stock.

What now?

Despite the excitement surrounding its stock split, the Alphabet share price is still down 20% this year. Fears of a recession have led investors to speculate that growth in advertising spending, Alphabet’s main source of revenue, will stall. As such, analysts’ earnings per share (EPS) estimates have seen downward revision over the last 90 days.

| Metrics | Revenue Estimate (Q2 2022) | Year Ago Revenue | 90 Days Ago EPS Estimate (Q2 2022) | EPS Estimate (Q2 2022) | Year Ago EPS |

|---|---|---|---|---|---|

| Figures | $70.32bn | $61.88bn | $27.38 | $26.25 | $27.26 |

Alphabet’s stock plunged after it reported its Q1 earnings results, as some key figures fell short of analysts’ expectations. Slowing advertising spending from the Russia-Ukraine conflict along with currency headwinds were some of the reasons cited by management for the underperformance. But with Alphabet set to report its Q2 results next Tuesday, I’m hoping that there will be better news. EPS is expected to come in lower than a year ago. But I’ll be paying close attention to the guidance provided, in hopes the group is on track to achieve 15% revenue growth for the year.

| Metrics (Q1 2022) | Figures |

|---|---|

| Total Revenue | $68.01bn (↑23%) |

| Operating Income/Margin | $20.10bn (0%) |

| Net Income | $16.44bn (↓8%) |

| Diluted EPS | $24.62 (↓6%) |

Searching for profits

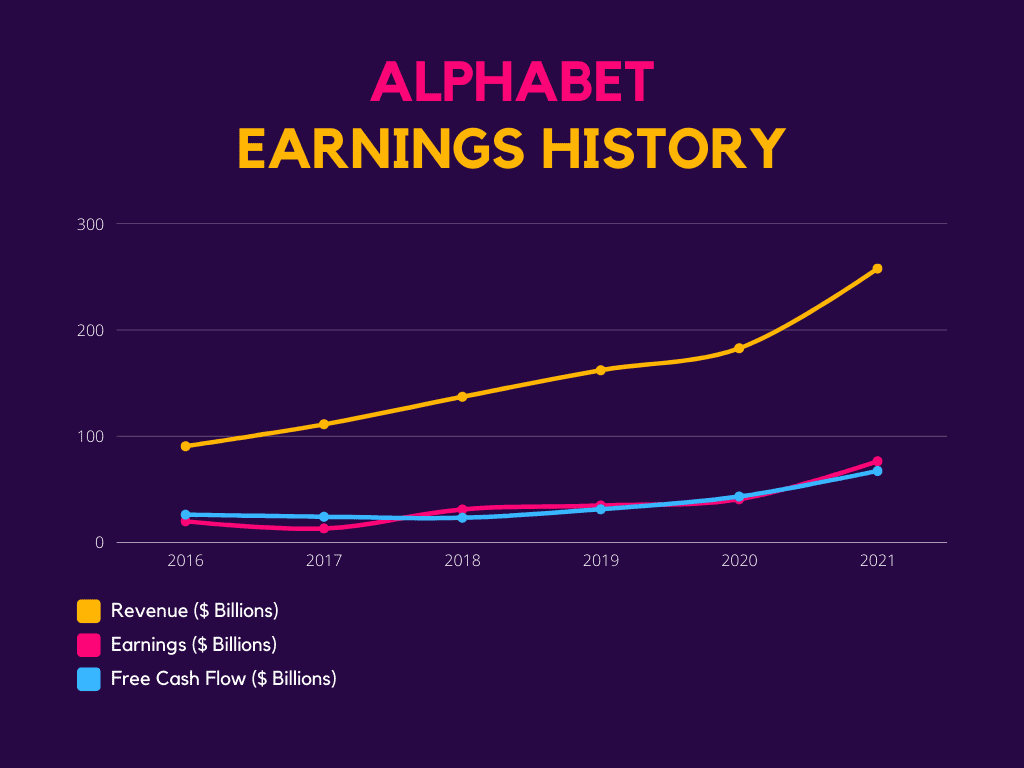

Alphabet stock is currently the largest holding in my portfolio, so should I be buying more? Well, the company has a flawless set of financials to begin with. A 5.1% debt-to-equity ratio and a mountain of cash ($134bn) puts it in an excellent position to grow and withstand an economic downturn. Additionally, it boasts high-quality earnings with excellent growth prospects from its latest developments. These include YouTube Shorts, Google Cloud, Google Workspace, Waymo, and even an improvement to Google Search.

So, with an average price target of $158.98, this gives the current Alphabet share price a 40% upside. As such, I’ll be looking to buy more of its stock as I believe Alphabet has the potential to substantially increase my wealth in the long term.