Rolls-Royce Holdings (LSE: RR) hasn’t paid out any dividends since before the pandemic. And City analysts don’t expect the enginebuilder to start again in 2022. But the Rolls-Royce dividend forecast suggests payouts could begin again from next year.

So should I buy Rolls-Royce shares for income?

Dividends tipped to restart

Rolls is predicted to get dividends rolling again at fairly modest levels in 2023 as balance sheet rebuilding continues.

The FTSE 100 firm is predicted to generate earnings of 4.02p per share next year as the civil aerospace steadily recovers. This is up an anticipated 1.47p for this year.

And it means that City analysts think Rolls-Royce will pay a total dividend of 0.7p per share in 2023.

Small acorns…

The problem for investors, is that the current Rolls-Royce dividend forecast creates a pretty weak yield.

The Rolls-Royce share price currently sits just shy of 90p per share. And so its dividend yield for 2023 comes in at 0.8%.

…to mighty oaks?

But of course, buying Rolls-Royce shares for income isn’t about today’s yields. It’s about the rate of dividend growth over the rest of the decade, and beyond.

Encouragingly the business continues to make great progress mending its balance sheet, providing a base for big dividends later down the line. In 2021, Rolls hit its £1.3bn run-rate savings target a full year ahead of schedule as it continued slimming down its operations.

A successful asset sales programme is also helping the business to slash debt. In fact, it looks on course to achieve its £2bn divestment goal with the sale of its ITP Aero unit, rumoured for completion in coming weeks.

Profits to fly higher?

Of course, future profits are critical when it comes to assessing dividend growth. And for Rolls-Royce there are several reasons to be pretty optimistic.

The civil aerospace sector is tipped to grow strongly over the medium-to-long term, meaning demand for Rolls’ engines and service operations should keep rising. The sales outlook at its defence division is also strong as global arms spending accelerates.

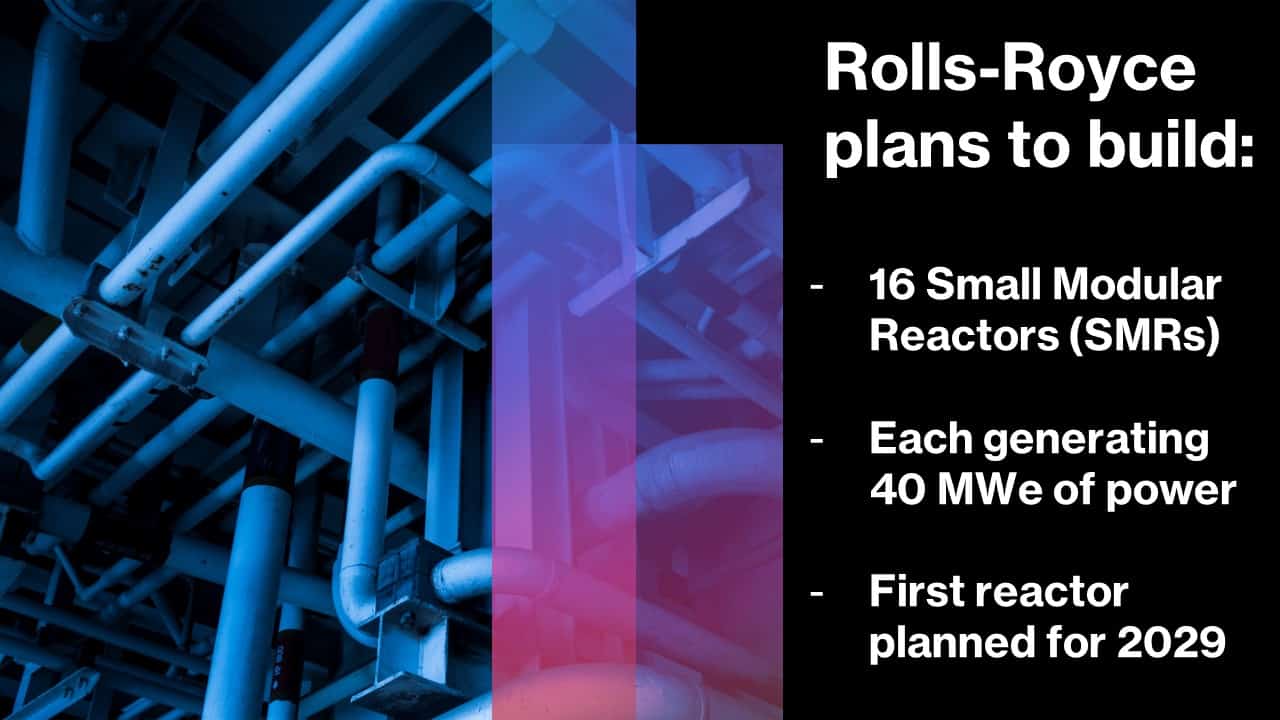

Also, I like the steps the business is taking to embrace green technology. Moves like developing cleaner plane engines and building small modular nuclear reactors could prove hugely lucrative as the fight against climate change intensifies.

High risk

However, I’m not tempted to buy Rolls-Royce shares just yet. I’m still massively concerned by the amount of net debt the business has on its books (£5.2bn, as of December).

I’m worried about how this will impact its growth plans and its dividend prospects in the near term and beyond. Rolls’ huge debts are particularly concerning, given the ongoing dangers facing the aviation industry.

The recovery in commercial travel threatens to be derailed by rising inflation and a spluttering global economy. Rising Covid-19 cases in major regions and soaring flight cancellations amid airport and airline staff shortages is another.

These all threaten Rolls-Royce’s ability to pay down its debt, increase profits and start growing dividends rapidly again. And they could plague the company for a long time. There’s a lot I like about the FTSE 100 firm. But, right now, I’d rather buy dividend shares that are on a sounder footing.