I’m currently looking for high-yielding dividend stocks to buy at bargain prices. In the stock market downturn, the share prices of many companies have taken a beating. This often results in rising dividend yields as a compensating factor.

Although there’s a risk of falling into a value trap, I think now could be an excellent time to take advantage of discounts on offer. Here are two dividend stocks — one from the FTSE 100 and one from the FTSE 250 — that I consider oversold at present.

Taylor Wimpey

The Taylor Wimpey (LSE: TW) share price is down 35% in 2022 following a difficult six months for developers, including competitors Barratt Developments and Persimmon.

Since reaching a five-year high just before the pandemic crash, the FTSE 100 housebuilder has surrendered over half its gains. Nonetheless, with a 7.4% dividend yield, the current share price of 115p looks tempting to me.

The FY21 results showed a return to strength, albeit not quite to pre-pandemic levels. The company’s operating profit margin was 19.3%, up from 10.8% the year before. Group completions, revenue and pre-tax profit were all considerably above 2020’s figures, but slightly trailed where the business was in 2019.

One highlight for me is the growing cash position. Net cash has consistently risen over the past three years to £837m. In my view, this is good news for the company’s future dividend payments after they were suspended amid the Covid-19 uncertainty.

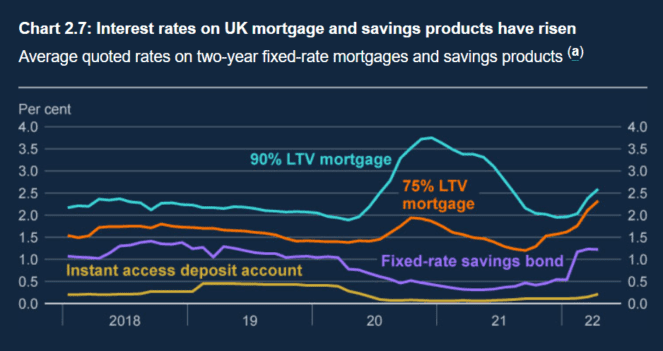

There are macroeconomic risks facing Taylor Wimpey shares. Interest rate rises are impacting the UK’s mortgage sector. Furthermore, due to a conveyancing logjam, the average completion time has soared to 22 weeks. A housing market slowdown could suppress the company’s share price growth over the coming months. Despite this, I’m still bullish on the long-term prospects for housebuilders.

Talk of 50-year mortgages might be part of the solution to the UK’s housing crisis, but a lack of supply remains the number one challenge in my view. This situation should benefit Taylor Wimpey in the years ahead. I’d buy this dividend stock today.

Micro Focus International

The Micro Focus International (LSE: MCRO) share price has also suffered this year, falling 38%. However, the juicy 8.7% dividend yield offered by this FTSE 250 software management business caught my eye.

The interim results for the six-month period ending 30 April revealed some weakness. Revenue declined 6.8% and adjusted EBITDA was down 9.5%. This caused some jitters, resulting in a 16% slump in Micro Focus International shares on results day.

However, it wasn’t all bad news for this company. A 5.3% fall in operating costs and a $545m reduction in net debt were positive signs for me. What’s more, the group’s policy of declaring a full-year dividend level that’s covered five times by adjusted profit after tax, as well as its strong cash flow generation should ensure future dividend targets are hit in my view.

The software provider has strategic relationships with Amazon, Alphabet and Microsoft. It assists thousands of customers in 180 countries in managing core IT elements of their businesses.

I believe a US stock market recovery could lead to further investment from US tech giants in their partnerships with Micro Focus International. I’ll buy before that happens.