The BT (LSE: BT.A) share price has managed to buck the trend of the FTSE 100 this year. While its overall index has declined 5%, BT is up 10%. Given its defensive status as a stock, it makes me wonder whether the UK’s market leader in telecoms can sustain its rally.

Forming connections

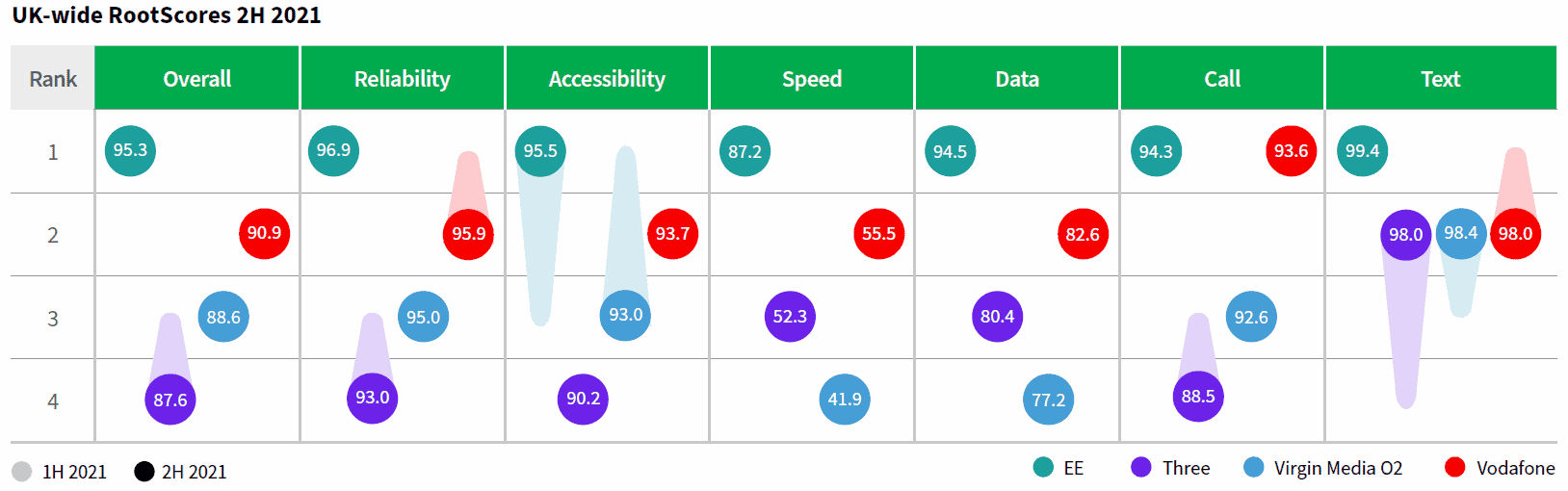

Aside from its defensive nature, BT has more things going for it. For one, its mobile network, EE has been named the best mobile network in the UK by RootMetrics. Additionally, its 5G network now covers 50% of the UK population, with the firm planning to continue investing in its expansion.

Secondly, the group’s Openreach network now covers 7.2m premises, providing 1.8m connections, with a strong and growing early take-up rate of 25%. This momentum has therefore allowed BT to revise its target of installing fast broadband fibre in 20m to 25m homes by 2026.

Discovering a brother

The blockbuster, however, is its joint venture with Warner Bros Discovery. The two giants agreed to form a premium sports JV for the UK and Ireland earlier this year. This combines the offerings of BT Sport with Eurosport UK. Therefore, customers can now enjoy the most extensive portfolios of premium sports. These include the UEFA competitions, Premier League, UFC, Olympic Games, the tennis Grand Slams, and many more!

Moreover, BT Sport announced yesterday that it had been chosen to remain the home of European football for the next five years. The FTSE 100 firm said that it will pay £305m per season to keep showing UEFA Champions League matches on UK television and online streaming from 2024 to 2027. Under the competition’s new format, there will be 27% more games for customers to watch each season. As such, I imagine this would bring in more revenue for its consumer segment.

Buy signal?

All of the above excites me very much. However, BT could run into a couple of roadblocks. The first would be the investigation of its joint venture. The Competitions and Markets Authority (CMA) fear that the partnership will reduce competition. So, an unfavourable outcome could end up denting the BT share price. The second is the recent news that its call centre workers and Openreach engineers have voted to strike. As a result, BT will most likely have to fork out bigger paycheques for its workers as a long-term solution, eating into its already declining bottom line.

This brings me to the state of the company’s financials. Aside from its sky-high debt of £16.2bn, it has been facing declining top and bottom lines. In fact, its earnings have dropped 9.9% on average per year for the last five years. When paired with its low levels of cash (£3.4bn), its fundamentals certainly look grim.

So, should I buy BT shares? Well, the stock has an average price target of £2.10, which would mean 10% growth from its current levels. This isn’t much, but it does suggest BT shares have the potential to continue their rally. However, given the uncertainty surrounding the JV and its poor financials, I won’t be investing in BT shares until there’s more clarity surrounding the inquiry and its balance sheet improves. Instead, I’ll be investing in companies with better fundamentals.