Ahh, Friday at last, and it’s time to kick back and relax with a well-earned….passive income cocktail?!

Trust me on this, and I’ll explain why passive income investing is really not all that different from mixing a great cocktail.

How to mix a passive income cocktail (aka portfolio)

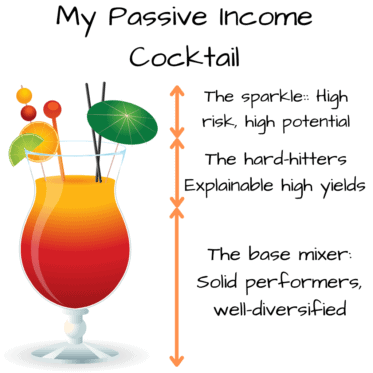

When building a portfolio, just like a tasty cocktail, I always want to start with a good mixer. Like a selection of well-diversified ETFs (exchange-traded funds) or investment trusts, with reliable dividend yields.

Then, I’ll want to add the ‘hard-hitters’. These should lift the cocktail flavour, as in the average weighted yield of the portfolio. Here, I’m looking for that magic combination of higher-yielding investments without any red flags.

Lastly, no self-respecting cocktail is complete without the finishing touch — so perhaps a sparkler or lime twist?! In my portfolio, that’s my riskier investment plays that may or may not pay off. This one should never be a main component but it sure can make the whole cocktail go off with a bang!

But what ingredients would I choose for today’s passive income cocktail?

My passive income cocktail recipe

When it comes to creating a great cocktail (or portfolio), it’s the proportions that matter. Get these right, and you end up with something that blends well to make an enjoyable drink, or a great retirement.

But if my cocktail is all sparkle without a reliable base? Well, we’ve all heard shocking Bitcoin stories, for example, not to be recommended.

Get it right and you end up with something like this:

What makes a solid investment base?

For the bulk of my portfolio I’m looking for investments such as City of London Investment Trust. It’s an investment trust containing well-known FTSE names that has grown its dividend for 55 years straight, currently paying about 4.7%.

I’d want to add others of course, since my perfect blend is diversified both geographically as well as across different sector types. But it’s a good example of the kind of reliable passive income investment I’d have here.

Which hard hitters make the grade?

Finding investments with high returns is simple, but it is time-consuming to weed out those with reasons to avoid them.

Two good examples to include would be perhaps Rio Tinto or an old favourite, City of London Investment Group. Both are high payers with good track records of rewarding shareholders, though Rio can tend to be cyclical.

A passive income twister?

Lastly, the sparkler of the cocktail, as in the high-risk investments of my passive income strategy.

Here, I’m looking for investments such as Polymetal, trading down 85% because of the Russian/Ukraine war. I need to be prepared to end up with nothing, but the reward could be great. Especially if it goes ahead with its dividends.

Finally — shake well (not stirred) — and enjoy!

The benefit of mixing together a passive income portfolio like this is the higher overall yield I hope to achieve.

If all goes well, its time to party! But if some of the higher risk elements fail, then I still have a solid base performance. It’s not all or nothing.

I just need to remember — passive income portfolios should always be enjoyed over at least three to five years — unlike the one to celebrate the weekend!