Once again, Tesla exceeded expectations in its first-quarter trading update a couple of days ago. In fact, total revenues were able to rise over 80% year-on-year to $18.7bn, while net income was able to rise an even more impressive 658% year-on-year to $3.3bn. This firmly cements Tesla as the leading EV stock, and partly justifies its $1trn valuation.

It also demonstrates that the EV sector is highly in demand, and this is good news for other EV stocks. But NIO (NYSE: NIO), an EV company that operates in China and has had far less success than Tesla over the past year. Indeed, whereas Tesla has managed to climb around 45% year-on-year, NIO stock has fallen over 50% in the same period. The EV sector remains extremely healthy, so can NIO now replicate some of Tesla’s success and start to soar?

Recent results

NIO has been growing at a slightly quicker rate than Tesla over the past couple of years. For example, in the company’s full-year results, it reported revenues of $5.6bn, a 122% year-on-year increase. On the other hand, Tesla saw a revenue rise of 71%. But the superiority of NIO over Tesla largely stops here.

In fact, NIO expects far slower growth during 2022, and in the first quarter, revenues are ‘only’ expected to increase around 22%. NIO is also unprofitable and doesn’t expect to reach any sort of profitability until 2024, at the earliest. Finally, as NIO is a Chinese stock listed in the US, there are also some delisting worries, due to geopolitical tensions between the two countries. Although there is some hope that this can be resolved, due to Chinese support towards US-listed stocks, this is still a worry to be considered. It means that, although Tesla’s recent results highlight that demand remains strong for EV, and this is a positive for NIO, I certainly wouldn’t buy on this fact alone.

Reasons to buy

Although NIO expects slower growth for the start of 2022, there are several factors that could propel its growth in the longer term. For example, NIO has plans to start expanding into Germany, the Netherlands, Sweden, and Denmark. Europe is a large market for EV and this will hopefully be able to boost NIO revenues.

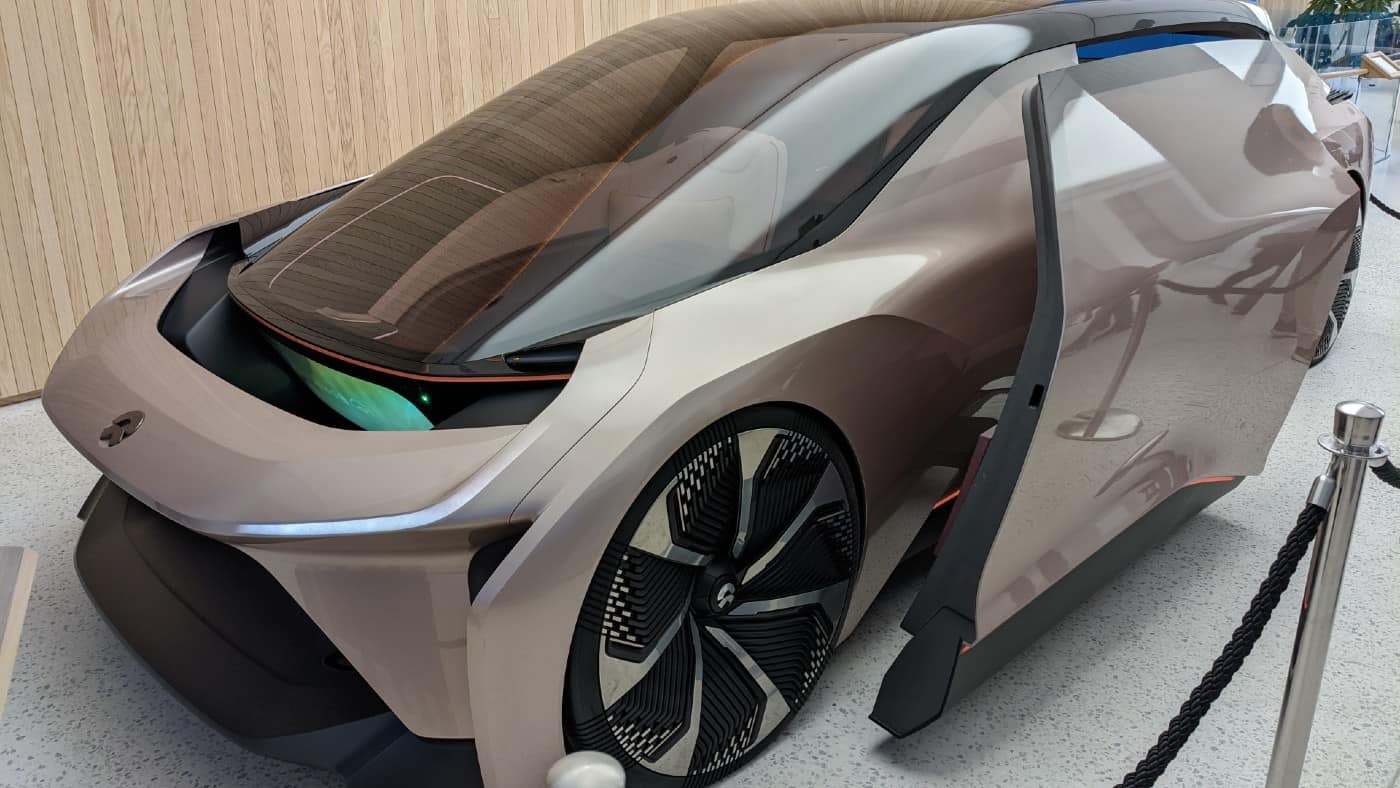

Further, in late May, the company expects to unveil the new ES8, ES6 and EC6 models. The addition of new vehicles is a major positive, which will hopefully aid the share price.

Finally, after its recent dip, the stock trades on a price-to-sales ratio of just five, far lower than Tesla’s ratio of well over 10. This implies that NIO may now be far too cheap.

Where next for NIO stock?

Tesla is the better-quality company on many measures and is the worldwide leader in the EV space. But this is reflected in the Tesla share price, which I feel is too high for me to invest in. Therefore, considering the disparity in the valuation between the two companies, I think it’s time for NIO stock to regain some ground. For this reason, it is certainly a stock on my watchlist.