Year-to-date, both NIO (NYSE: NIO) and Tesla (NASDAQ: TSLA) have underperformed the Nasdaq index. Indeed, while the Nasdaq has fallen around 13%, Tesla has fallen nearly 15%, and NIO an even more depressing 40%. But electric vehicle (EV) makers remain in demand, and I feel that the current high price of oil will speed up the transition. As such, should I be buying Tesla stock or NIO today?

NIO stock: incredible growth, but Chinese worries

NIO has been able to grow revenues dramatically over the past few years. In the recent full-year results, it reported revenues of over $5.6bn, a 122% increase year-on-year. Deliveries of vehicles also reached over 91,000, up over 109% from the previous year. These are incredible growth figures and illustrate the incredible potential of the company.

But there are signs that growth is starting to slow. For example, total revenues for the first quarter of 2022 are expected to increase only around 22%. Evidently, this growth is far slower than over the past year and is a worry trend.

There are also concerns about the potential delisting of Chinese stocks in the US, which adds an extra risk to NIO not found with Tesla stock. This is mainly due to the tensions between the two countries. But there have been signs recently of support from China towards US-listed stocks, signalling things may change. That means the delisting threat could recede.

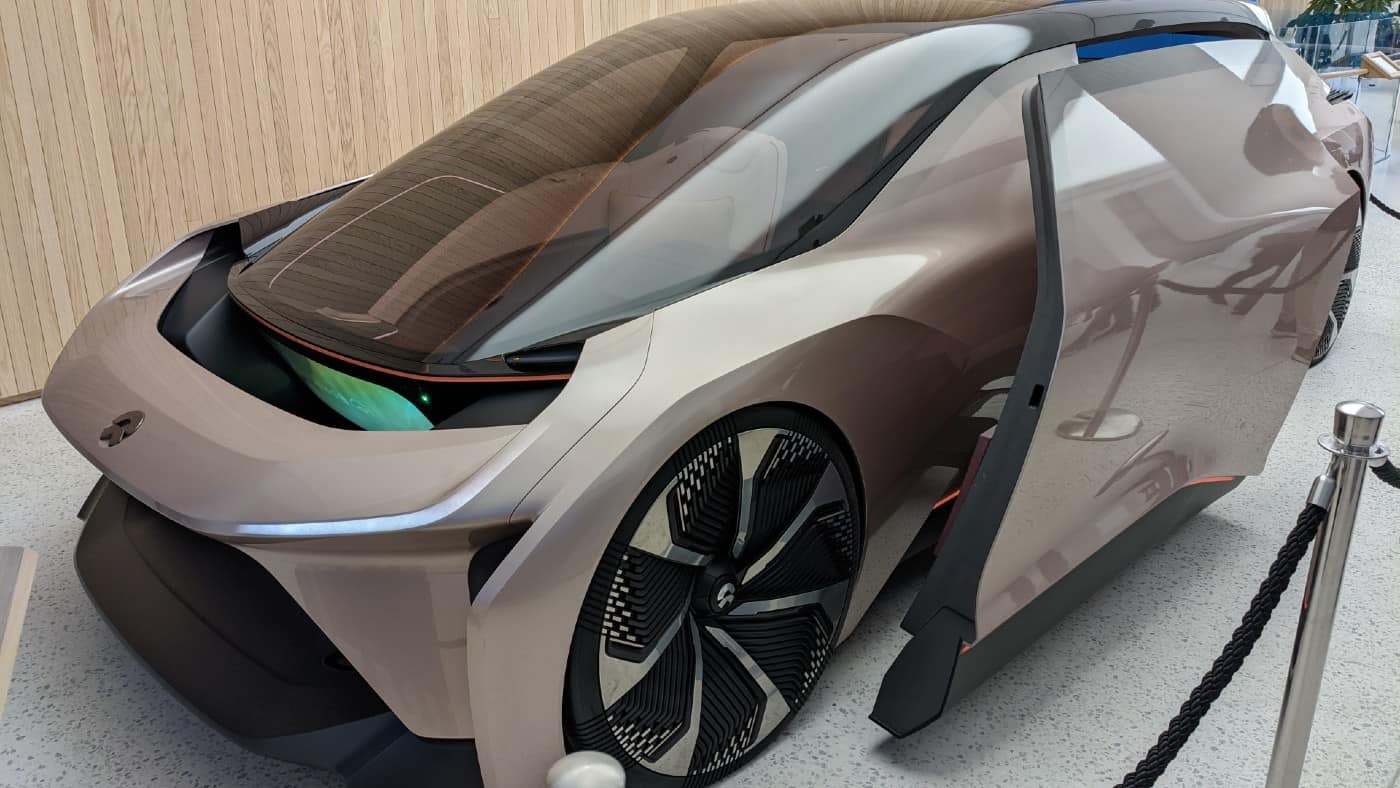

Overall, I’m tempted to start a small speculative position in NIO. While growth has slowed recently, there is plenty of hope for the future, including the launch of new vehicles and expansion into Germany, the Netherlands, Sweden and Denmark. There is also hope that it may reach profitability by 2024, which would be a major achievement. For these reasons, the current dip seems a great time for me to buy.

Tesla stock: more mature but experiencing growth

Tesla stock has been far more resilient than NIO over the past few months. This may be because it has a proven record of profitability. In 2021, revenues rose 71% year-on-year to $53.8bn, and net income totalled $5.5bn. Further, despite the semiconductor shortage and supply chain challenges, Tesla managed to produce 305,000 vehicles in the first quarter of 2022. These are exceptional numbers and demonstrate the company’s prowess and competitive advantage over other EV makers.

But there are some risks associated with Tesla. In particular, there is growing competition in the sector. This includes new entrants to the market, such as Rivian and Lucid Motors. Further, Tesla stock trades at a price-to-sales ratio of over 10, which is very high, and definitely higher than NIO. This suggests to me that future success is already priced in and there may be limited upside potential. For these reasons, I won’t be buying Tesla. In the NIO vs Tesla battle, NIO wins out for me.