FTSE 100 basic materials giant Rio Tinto (LSE: RIO) has a yield of 10%. Should I buy this dividend stock? Here’s my take.

Rio Tinto has interests in exploring, mining, and processing mineral resources worldwide. The company offers aluminium, copper, iron ore, and minerals such as titanium dioxide, diamonds and borates among others. Rio Tinto is expanding its frontiers and meeting the increasing demand for critical minerals, such as lithium and scandium.

The lithium market is increasing massively, and nowadays it is used in rechargeable batteries for mobile phones, laptops, digital cameras and electric vehicles. Recently, Tesla announced the switch to lithium in its longer-range vehicles.

Results

On 23 February, Rio Tinto announced annual results for the year ended 2021.

At £63.5bn, sales rose 42% year-on-year (YOY). The bottom line moved 116% higher to £21.1bn, the biggest surge in the firm’s history. The company sustained its debt stable and positively increased its cash and cash equivalents from £12.9bn to £15.2bn. Free cash flow increased 88% YOY to £17.7bn even after £15.3bn in dividends were paid to shareholders. As a whole, the company has done an amazing job improving its balance sheet, leaving it in a very strong position to grow.

It will be difficult to maintain growth next year after a great 2021. In addition, operating costs are expected to rise, which could squeeze profits. As a result, I will be paying attention to Rio Tinto’s performance in the coming quarters/years.

Dividend

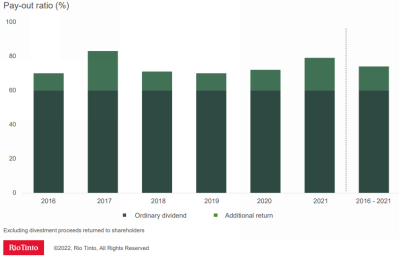

With a dividend yield of over 10%, it is clear that will be difficult to continue to increase its dividend as it did in the past. But is this a safe dividend or could the company cut it in the near future? Well, with an 60% average pay-out ratio over the past six years, it reflects an exceptional financial result, strong balance sheet and disciplined ramp-up of investment. It makes me comfortable to say the company has no need to cut its dividend.

Final thoughts

Because of this, I am very optimistic in my outlook for Rio Tinto. Furthermore, since the Russian invasion of Ukraine, commodities have been heavily affected and volatility is on. Several companies in this sector have been affected by geopolitical tension. Fortunately, Rio Tinto does not operate in any of these countries, and its operations were not directly affected. That doesn’t mean its share price would not suffer.

From a valuation standpoint, Rio Tinto has a price-to-earnings (P/E) ratio of 6.4 times and a price-to-sales (P/S) ratio of 2.13 times, which makes it undervalued compared to FTSE 100 peers.

While in the short term there is turmoil in the market, there is a lot to like about this company in the long term, which is why I have added the stock to my portfolio with a view to holding for at least the next five years.