In mid-April, Coinbase (NASDAQ: COIN) went public via a direct listing. In an article on the day of the listing, I said I was going to leave the stock on my watchlist, due to its high valuation.

That was the right move, in hindsight. Since then, Coinbase’s share price has fallen from $328 to $224. That’s a decline of about 30%.

Has the share price pullback changed my view on Coinbase? Let’s take another look at the stock.

Coinbase stock: is it a buy?

In my last article on COIN, I said there were several things I liked about the company from an investment perspective. Today, I still see things I like.

One that appeals to me is it’s essentially a play on the crypto industry as a whole. As a crypto-asset exchange, it’s going to generate revenues from traders no matter whether crypto assets are in favour and no matter whether they’re rising or falling. If we assume crypto’s here to stay (and that’s a big assumption, in my view), Coinbase should do well in the long run.

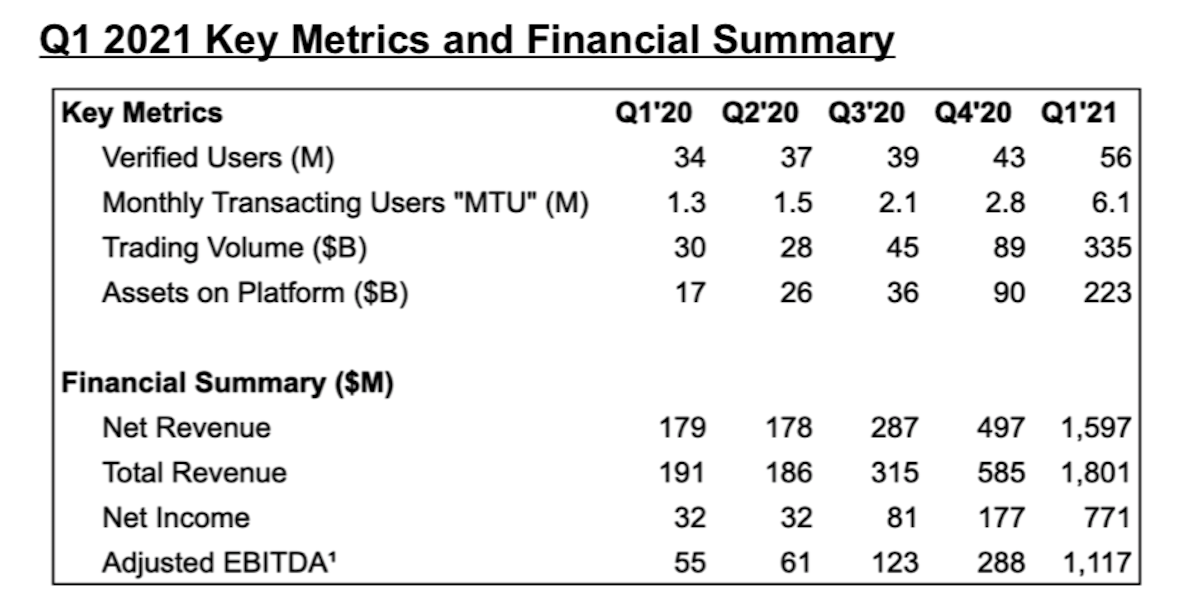

Another thing I like about Coinbase is it continues to grow at a fast pace. Below are some key metrics for the first quarter of 2021. In Q1, both revenue and net income climbed significantly. Meanwhile, verified users jumped 30% over the quarter. It’s worth noting that, unlike many other high-growth stocks, Coinbase is profitable (at the moment).

Source: Coinbase

Additionally, we’re seeing some positive sentiment towards the stock from brokers right now. Analysts at Wedbush, for example, recently initiated coverage with an ‘outperform’ rating and a $275 price target.

Finally, Cathie Wood has been loading up on Coinbase stock recently. Given Wood’s track record in the technology space, I see this as a positive.

Risks

I still have some concerns about COIN stock however. One is that revenues (and the share price) are going to fluctuate a lot.

Coinbase’s revenues are influenced by the prices of Bitcoin and other crypto assets which, in turn, are influenced by influencers such as Elon Musk. When Musk tweeted that Tesla would no longer be accepting BTC, Coinbase stock was hammered. That’s not ideal from an investment point of view. I like to invest in companies that are in charge of their own destiny.

Another concern is in relation to long-term profitability. Coinbase has historically generated high revenue and been profitable during periods of strong crypto-asset prices. However, it has lost money when prices are low.

A third concern is insiders may continue to offload stock. With a direct listing, insiders aren’t obliged to hold on to their stock for a certain period of time, like they are with an Initial Public Offering (IPO). Insiders have already dumped a lot of Coinbase stock ($4.6bn worth in the days after the direct listing), but they may not be finished selling. This could put further pressure on the share price.

A final concern is the stock’s valuation. Currently, the company has a market capitalisation of $47bn. That still seems high to me.

Coinbase stock: my move now

Weighing everything up, I’m going to keep COIN on my watchlist for now. At this stage, I’m still not convinced that the risk/reward proposition is attractive.