Tech shares have been the big growth story of recent years. But many tech stocks look expensive to me after the big gains we’ve seen over the last 12 months.

Paying too much for a stock can limit long-term returns. To solve this problem, I’ve been hunting for good quality UK tech shares trading at attractive prices. I reckon I’ve found one company that I’d be happy to buy today.

Profits up 35%

The business I’ve chosen is cyber security group Avast (LSE: AVST). The firm is well-known among home computer users for its free anti-virus software. But Avast does a lot more than that, offering a range of more sophisticated paid products for home and business users.

Avast has been in business for 30 years and floated on the London market in 2018. I admit that I normally look for a slightly longer history, but that isn’t always possible in the tech sector.

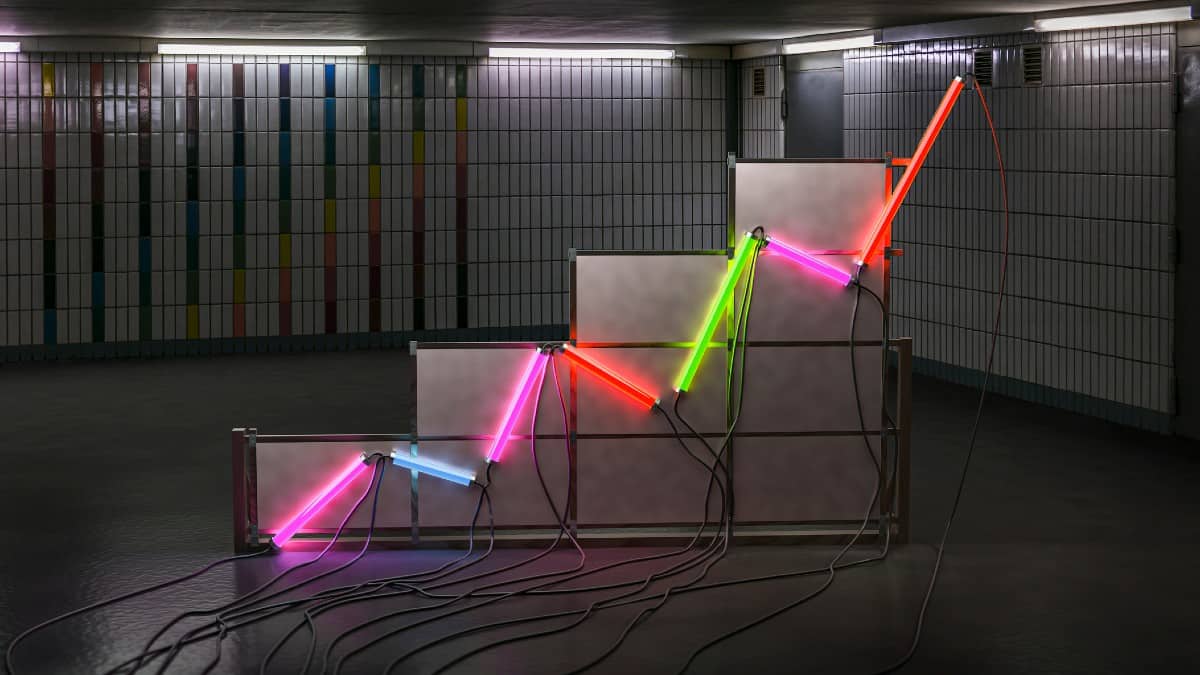

As it turned out, Avast’s performance has remained strong since its IPO. The group’s operating profit has risen by 35% since 2018 and has tripled since 2015.

I reckon this tech share could keep growing

Avast obviously faces tough competition from well-known rivals such as Norton and Kaspersky. I can’t be sure how it will perform against its competitors. But I think there should be plenty of growth to share around between them all.

According to Avast, the wider market for its products is growing by around 10% each year. I think that should make it easier for it to keep growing than it would be in a more mature market.

Another thing I like about Avast is that the founders Pavel Baudis and Eduard Kucera are both still involved in the business. The two men sit on the board as non-executive directors. Between them, they control around 35% of Avast stock, worth around £1.7bn.

CEO Ondrej Vlcek is also a major shareholder. Mr Vlcek has a 2.3% shareholding which I estimate is worth around £110m. He’s been with Avast since 1995, when he joined as a software developer.

With stable and invested directors, I feel confident that Avast will stay focused on delivering sustainable long-term growth. That’s just what I’m looking for in a tech share.

What could go wrong?

No company is perfect. Avast operates in a competitive market and it needs to continue attracting new users. It needs to continue investing in its technological capabilities while maintaining a strong public profile. I do wonder if Avast’s brand isn’t quite as strong as its better-known US rivals.

Another concern is that it didn’t make big gains last year, despite the surge in home-working. The company’s adjusted revenue for 2020 only rose by 7.9%, excluding the impact of exchange rates.

Avast has underperformed the FTSE 100 this year, but I think this tech share is starting to look quite reasonably valued. Broker consensus forecasts for 2021 price the stock on 17.5 times earnings, with a dividend yield of 2.6%. I’d be happy to buy the shares at this level, as I think they offer good long-term growth potential.