Making mistakes is part of investing. Even the world’s best investors, such as Warren Buffett, make mistakes at times.

However, there are a number of classic mistakes that investors make time and time again. If I avoid these mistakes, I’m likely to have much more success as a stock market investor.

Trying to get rich quickly

Trying to get rich quickly is probably the most common mistake stock market investors make. Instead of building a balanced portfolio of high-quality stocks and aiming for a 10% return per year (which can make one very wealthy over the long term), many investors try to double or triple their money quickly by investing in high-risk, speculative stocks.

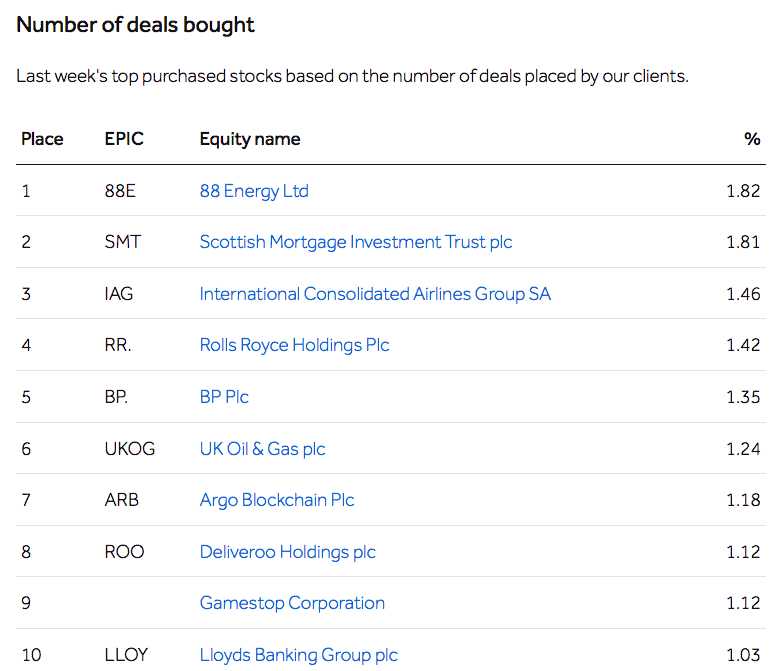

Just look at this list of the most purchased shares on Hargreaves Lansdown. Many of these stocks, such as 88 Energy, Argo Blockchain, Gamestop, Deliveroo (and even Rolls-Royce and IAG to a degree) are highly speculative in nature. But I’m not likely to see top investors like Buffett or Terry Smith buying these shares.

Source: Hargreaves Lansdown. Data: 16/4/2021

Speculative stocks can make me money, of course. However, the risks are high. More often than not, investors suffer losses from these types of stocks (been there, done that!) and this sets them back significantly.

It’s worth remembering that if I lose 50% on a stock, you have to make a 100% return just to break even.

Not diversifying properly

A second mistake that a lot of investors make is not diversifying their portfolios properly. Many investors only own a handful of stocks and quite often, one or two of these stocks represent a substantial proportion of the portfolio. Recently, I’ve seen beginner portfolios where Tesla is 50%+ of the total.

Lack of diversification can hurt an investor badly. If Tesla is 50% of my portfolio and the stock drops 50% in value, then I’m looking at a 25% loss across the portfolio, assuming the other stocks don’t change in value. This means I’d need to make a 33.3% return across my whole portfolio to break even.

Most professional money managers tend to own at least 30 stocks. They also tend to keep individual stock weightings below 5% of their overall portfolios. This limits their stock-specific risk. If one or two stocks in the portfolio underperform, overall performance won’t suffer too badly.

Not thinking long term

Finally, another mistake that investors make is not thinking long term. All too often, investors buy a stock and then panic, and sell it when it falls 20% in the short term.

Volatility is part of stock market investing. In the short term, it’s normal for stocks (especially growth stocks) to fluctuate 20% or more. The key is to stay calm and focus on the development of the underlying business.

I have a great example here. In 2018, I bought shares in Clipper Logistics. My timing was absolutely terrible – after I bought the stock, it fell from 470p to 150p in the next two years. However, I held on to it because the business was always growing. This patience paid off. In the last 12 months, Clipper shares have had an incredible run and today I’m up over 40% on the stock. That’s a solid return in three years.

Investing in the stock market is a long-term game. Invest in top companies and hold them for the long term, and the chances are an investor will be rewarded.