Portfolio manager Cathie Wood is very much in the spotlight right now. It’s not hard to see why. Over the last 12 months, her flagship fund, the ARK Disruptive Innovation ETF, is up a huge 160%. By contrast, the UK’s FTSE 100 index is only up about 20% for the year.

Here in the UK, it’s hard to invest in Wood’s funds. However, it’s not hard to invest in stocks owned by the portfolio manager. With that in mind, here’s a look at a growth stock she owns that I’d be happy to buy for my own investment portfolio today.

A top Cathie Wood FinTech stock I’d buy

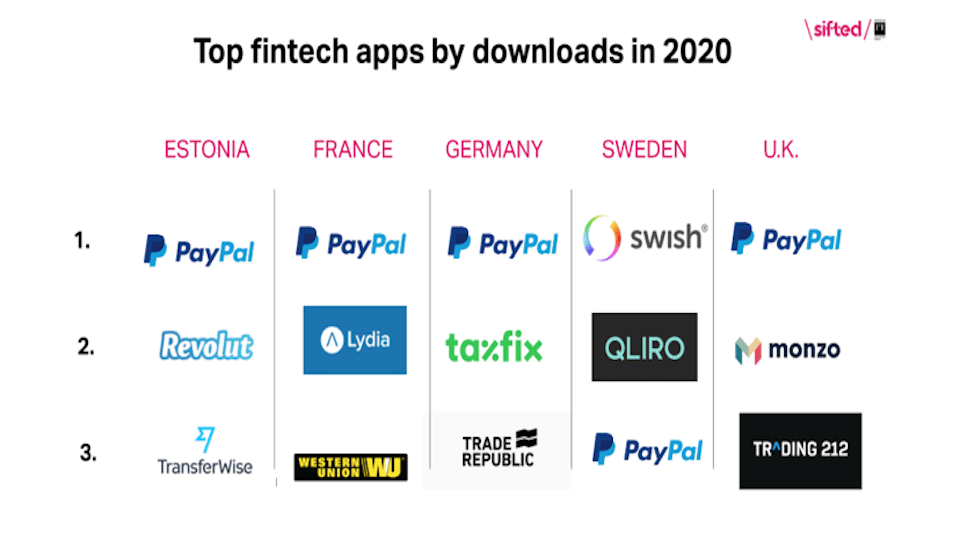

One of my favourite Cathie Wood stocks right now is PayPal (NASDAQ: PYPL). It’s a key player in the payments and financial technology (FinTech) industries. Across the world, over 300m people trust PayPal to buy, sell, and send money securely. Last year, it was the most downloaded FinTech app in the UK.

PayPal is a top 10 holding in Wood’s FinTech Innovation ETF and also held in her Disruptive Innovation and Next Generation Internet ETFs. It’s worth pointing out that Wood isn’t the only star portfolio manager that owns the stock. It’s also held by Terry Smith (aka ‘Britain’s Warren Buffett’) in his Fundsmith fund.

Source: Sifted

Why I’m bullish on PayPal stock

I’m bullish on this Cathie Wood stock for a number of reasons. One is that the company is growing at a rapid rate. In Q4 2020, for example, the company added 16m new active accounts and generated revenue and earnings growth of 23% and 29% respectively. For 2021, it expects revenue and earnings growth of about 19% and 17% respectively.

Another is that the company is well placed to benefit from the shift away from cash. According to Accenture, 2.7trn transactions are set to move from cash to cards and e-payments by 2030. This structural shift in payments should benefit PayPal.

The company also looks well placed to benefit from the growth of e-commerce (online shopping). This is an industry that has grown significantly in recent years. However, in the years ahead, it’s likely to get much bigger.

Finally, I like the fact that the company is very innovative. Just recently, it announced the launch of ‘Checkout with Crypto,’ a new feature enabling customers with cryptocurrency holdings in the US to buy goods with crypto seamlessly. It plans to bring this feature to the UK and other countries in the near future.

Risks

Right now PayPal is an expensive stock, even after a recent pullback. Currently, the stock sports a forward-looking price-to-earnings (P/E) ratio of about 52 and a price-to-sales ratio of about 10.8. These valuations add risk to the investment case. If growth slows in the future or the company experiences setbacks, the stock could experience weakness. It’s worth pointing out that PayPal faces significant competition from the likes of Square – which owns Cash App – and other innovative players in the industry. This also adds risk.

I’d buy this Cathie Wood stock today

Looking at the long-term growth potential here, however, I’m comfortable paying a higher valuation for the stock. After the recent share price pullback, I’d buy PayPal for my own portfolio.