Tech stocks have been all the rage this year, with many of them reaching astronomical price points and incredible valuations, both in the UK and in the US. For some, this has been well deserved, but it’s also led to others becoming overvalued. Two top tech stocks I’d consider buying in a second 2020 stock market crash are Experian (LSE:EXPN) and dotDigital (LSE:DOTD). I think both look poised for a long profitable future ahead, but may be a bit pricey to buy at today’s share price.

Cashing in on the data revolution

Experian provides credit rating information for individuals and businesses and operates worldwide. This responsibility has transformed it into one of the world’s biggest data processing companies. The Experian share price has been on an upward trajectory for the past 10 years and that’s despite a data breach scandal five years ago.

The downside to this share is that its price-to-earnings ratio is 53. But like most excellent tech companies this year, that’s par for the course. It also offers a dividend yield of 1.2% and earnings per share are 57p.

One of the key factors Warren Buffett looks for in a company he’s considering buying shares in is an economic moat. That means he looks to see if it has a competitive advantage over its peers. In the case of Experian, it absolutely does. It’s been gathering and analysing consumer credit information for decades, which means its database of records is extensive. Despite its consumer facing image, it generates 80% of its revenue through its business-to-business processes.

UK fund manager Nick Train just added Experian shares to his Lindsell Train UK Equity Fund and to his Finsbury Growth & Income Investment Trust. He rarely buys UK stocks, so this indicates a particularly strong show of confidence for the stock.

Internet marketing

dotDigital offers a range of Internet marketing solutions including email marketing and personalised marketing campaigns. Big-name customers include British Airways, Science in Sport, and City & Guilds. And it integrates seamlessly with e-commerce software providers Microsoft Dynamics 365, BigCommerce, Shopify, and Magento.

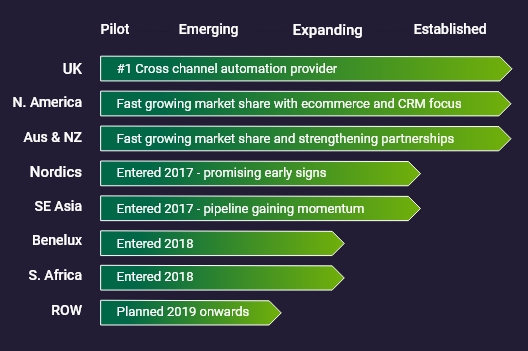

It has shown strong performance both in the UK and internationally. According to its 2019 annual report, the marketing automation market is predicted to grow to $25.1bn by 2023. It hopes to take full advantage of this and is further enhancing its AI-driven and machine learning capabilities, to focus on continued growth.

dotDigital has a market capitalisation of £430m and price-to-earnings ratio is 50. Earnings per share are 2.8p and its dividend yield is 0.4%. As its share price is now trading on an all-time high, I’d deem this expensive, but I think it has a strong future ahead and I’d consider buying dotDigital shares during a market crash. I think both these stocks would be a good addition to a long-term investor’s Stocks and Shares ISA.