Investing in Bitcoin and other cryptocurrencies reached its peak in 2018. As we all know, a dramatic crash followed. I’d forget Bitcoin and do this instead to get rich.

Why do people invest in Bitcoin?

There’s been much hype recently about the future of cryptocurrencies and Bitcoin as the best known one. But why is that? Well, the idea behind Bitcoin’s creation was enabling quick and cheap online payments without the need to use traditional banking. Indeed, using Bitcoin is quite confidential, cheap, and easy. Everyone decided the new cryptocurrency would quickly replace the traditional currencies.

But the most recent popularity was the result of central banks’ monetary policy. Due to the coronavirus crisis, most monetary regulators had to flood the markets and economies with liquidity. This led to many fiat currencies’ devaluation. Funnily enough, there has been no hyperinflation. In fact, many countries and the eurozone are suffering from zero or even negative inflation. At the same time, there is too much printed money. So, it looks like investors want to get rid of the fiat currencies and invest the money they have.

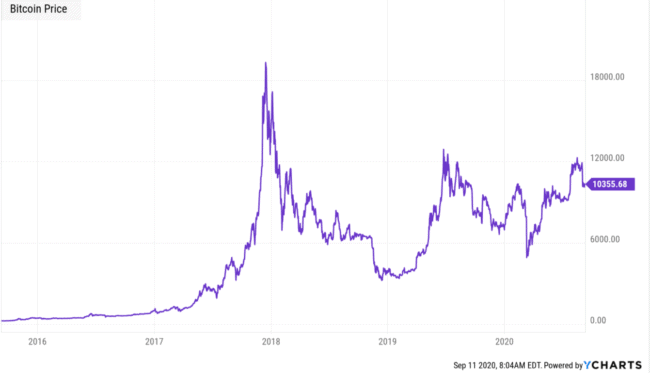

As can be seen from the graph below, an impressive Bitcoin rally started after the March stock market crash.

Bitcoin price in USD

Source: YCharts

Why I don’t recommend investing in Bitcoin?

Just like my colleague Rupert, I consider Bitcoin to be highly risky. Indeed, it is quite easy to steal Bitcoin and stay unpunished. Apart from Bitcoin, there’re other cryptocurrencies. And we don’t know for sure which one will be in use a couple of years from now. What’s more, cryptocurrencies have no intrinsic value. In other words, they are perfectly intangible. A Bitcoin is worth only as much as people are willing to pay for it.

It brings me to my favourite shoeshine boy story. One day in 1929, Joe Kennedy from the famous Kennedy family had his shoes shined. The boy started giving Joe Kennedy stock tips. The latter realised the stock market was extremely popular and therefore must be overvalued. So, he decided to sell all his stock holdings. He was right in doing so because an unprecedented market crash happened soon afterwards. There seems to be a similar story with Bitcoin investing. There’s hardly a person who hasn’t heard of this cryptocurrency. I believe its price is due to all this hype.

I’d buy gold and silver miners

Please don’t misunderstand me. I think investors can make a fortune now when macroeconomic indicators are poor and central banks pump in so much money. But I’d go for traditional safe havens. These are gold and silver. Both have limited supply and it’s impossible to print more metals. But bear in mind that gold prices are much less volatile than silver prices.

However, the two metals have high storage and insurance costs. What’s more, they don’t pay any interest. So, I’d prefer to buy gold and silver miners’ shares instead. I wouldn’t have to pay any storage costs. What’s more, investing in large profitable companies is a low risk. And many of them also pay dividends.