easyJet shares have had a tough time this year. In fact, it looks like the company is still in deep trouble. But is the stock a bargain or a value trap?

Recently easyJet announced that it will have to close its bases at Stansted, Southend, and Newcastle. This means the airline will have to cut 670 jobs. I think it’s a clear sign that air travel activity is nowhere near its pre-pandemic levels. In fact, it looks like the airline industry is still shrinking.

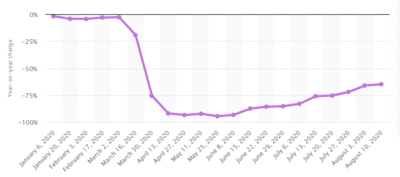

Year-on-year change of weekly flight frequency, UK

Source: Statista

If we look at the graph above, it might look as if air travel is experiencing an upturn. However, the journey to recovery is slow. Airline activity levels are still down about 65% year-on-year.

easyJet shares

My colleague Harvey wrote an excellent article about the risks of investing in an airline. I agree that the future for the industry looks highly uncertain. After all, summertime has always been profitable for airlines but this year is clearly an exception. On 15 June, easyJet was allowed to resume flights, but the airline expects to only have 40% capacity this quarter. Although that’s an improvement, it’s quite a pain for the company. At the same time, this estimate is rather optimistic. The thing is that the UK government reintroduced a quarantine for travellers from many countries, including France, the Netherlands, and Monaco. So, easyJet’s passenger traffic might even fall short of expectations.

easyJet has an important advantage of being the ‘lean and fit’ industry leader. What’s more, it has plenty of cash. On the other hand, its shareholders got diluted when the company issued more stock in an effort to raise additional cash. The firm’s net debt (debt less cash) rose almost twofold over a period of just three months. On 30 June the company’s net debt was £835m compared to £467m on 31 March. That’s pretty bad. The revenue for the quarter was just £7m.

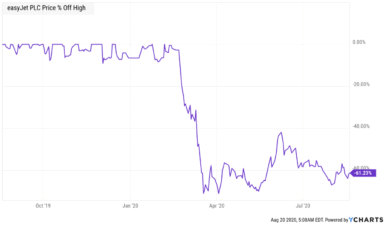

Not inspiring. Neither is the company’s stock price, which is down almost two-thirds from its February highs.

easyJet share price

Source: YCharts

A bargain or a value trap?

It might look like the market is perfectly rational right now. But many investors buy for the ‘bright future’. How likely is easyJet to have one? If it is likely, then its stock is clearly a bargain. If not, it’s a value trap.

Here are the key questions investors should ask.

First, how much time will it take the airline industry to recover? According to Moody’s basic scenario, the airline industry will only recover in 2023. This forecast, however, is highly uncertain. It might recover much earlier if an effective coronavirus vaccine becomes available soon enough. But if Covid-19 gets totally out of control, I’m afraid it will take the industry even longer to recover.

Secondly, how sound is the company’s financial position? easyJet is currently rated as Baa3, which is very low investment-grade. Although the cash pile is impressive, the cash burn rate is really high.

Even though the airline is one of the industry’s leaders, it is quite a risk now as an investment, I think. I’d only recommend brave investors to buy easyJet shares. But if you are rather risk-averse, I’d suggest looking elsewhere.