Many of the world’s billionaires can credit their wealth to a lifetime of buy-and-hold investing. They usually achieve this by buying an undervalued stock and resisting the urge to sell, even when the financial markets are in turmoil. This can be a tough concept for new investors to grasp, but the reason is simple — compound interest works wonders.

What is compound interest?

Compounding is the power of earning interest on your investment, and as that investment grows, so does the amount paid (earning interest on interest), compounding the starting pot exponentially. This is way more powerful than it first seems, even though a buy-and-hold strategy may not seem lucrative at first. But I think its beauty lies in its simplicity and perceived ability to achieve the impossible.

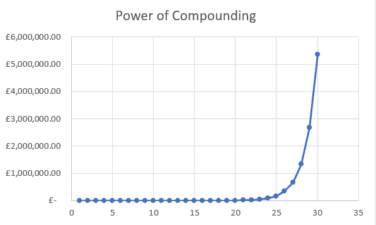

For example, if you take 1p and multiply its value every day for a month, by day 30, you will have over £5.3m.

That is a crude example of the power of exponential compounding, but it illustrates how the acceleration of wealth occurs towards the end of a long period. Following this premise, stocks that pay dividends, which are reinvested to accumulate more shares, enjoy a similar trajectory.

This explains why dividends have always been the lifeblood of a value investor’s portfolio. Unfortunately, the pandemic has thrown a spanner in the works, resulting in 445 London listed companies cancelling, cutting, or suspending their dividend payments in recent months.

Is value investing a wise strategy?

As there is no sign of a quick recovery from the Covid-19 situation, it is unlikely many of these dividends will be reinstated quickly. So, is value investing still a wise strategy to follow in these times?

I believe it is. Financial markets have always been subject to peaks and troughs, but the overall trend has moved upwards. Of course, past performance is not a definitive guide to future performance, but as long as there is a stock market, I think there will be listed companies enjoying long-term growth and expansion. With that in mind, this is a great time to buy into stocks that are currently undervalued and are likely to recover with time. Some companies with a reduced dividend still offer a decent yield. If it looks like a company can sustain the headwinds and eventually recover, this could be a great time to buy.

Set and forget

Focusing on the big picture and ignoring the short-term landscape is the key to building long-term wealth. If you invest a lump sum with dividend reinvestment activated, it will eventually accumulate. For example, if you invest £1,000 and add no additional capital, but reinvest the dividends at a rate of 5%, your final sum after 40 years will be over £7,000.

If you do the same, but also invest an extra £100 a month, your final total will be over £155,000.

If you increase the interest rate to 11%, the above scenarios will increase the final total to more than £65k and £804k, respectively. The more you can afford to invest and the higher the interest rate, the better your investment will perform. If you want to get rich and retire early, I think you should follow in the footsteps of stock market billionaires. Follow a value investing strategy that takes full advantage of the power of compound interest.