Ocado (LSE:OCDO) shares have had a great time this year, indeed. Food delivery services are really popular now due to the pandemic. But is Ocado stock still a buy?

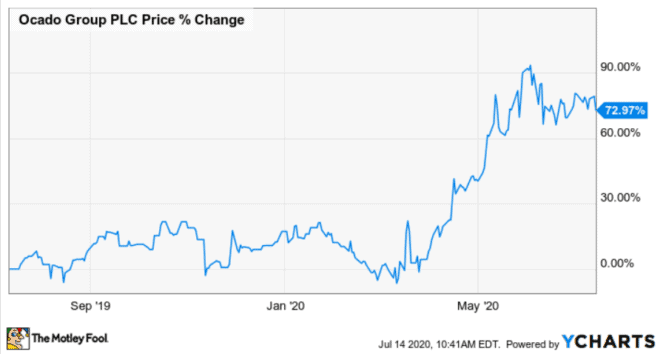

Ocado shares are up over 70%

As you can see from the graph below, the shares have gained more than 70% since March. It’s quite impressive.

Ocado shares surged because the first half of 2020 was marked by a 27% rise in the company’s sales. But Ocado’s CEO doesn’t think it was a one-off. He even says that the move to online shopping is quite permanent. But is it really so? And how about the company’s fundamentals?

Successful company?

To start with, I think the food delivery industry still offers plenty of growth potential. The coronavirus pandemic made many of us reconsider our habits. And many consumers have discovered they like the idea of food being delivered directly to their doorsteps. So, even after the end of the pandemic many people might continue to order their essentials online.

It seems that Ocado has a great competitive position. The storage costs are quite low and the company’s business model is focused solely on food delivery. But still, a rising number of traditional supermarkets have started offering such services. A brilliant example is Tesco. So, keeping the old customers and getting the new ones is quite a challenge to Ocado.

Financial fundamentals

Let us consider the financial fundamentals of Ocado shares. Yesterday the group reported its earnings for the first half of 2020. If you have a quick look, it might seem like Ocado’s financial results have improved substantially. The loss before tax decreased from £147.4m in the first half of 2019 to just £40.6m in the first half of this year. But I wouldn’t be that optimistic. In fact, the £147.4m loss in the first half of last year seems to be a one-off. This is because it was due to the Andover fire that destroyed some of the company’s assets.

In spite of the unprecedented demand – that Ocado wasn’t even able to fully handle in the first several days of the lockdown – the company didn’t manage to break even. Instead, the company’s management invested heavily in international expansion. For example, it opened customer fulfilment centres in Toronto and Paris. The company also bought some innovative equipment, including robots, to help facilitate packaging and delivery. I realise that it’s important to do such things if a business wants to grow. I agree that investing in new technologies might reduce costs in the long run. But I don’t think it’s in the best interests of the shareholders to expand internationally while not being able to achieve profitability in the company’s core market.

The management also seems to be proud of the balance sheet improvement. Indeed, its cash holdings totalled £2.3bn as of the reporting date. But the main question is how Ocado achieved this. Well, Ocado borrowed heavily and issued even more shares. This means that the existing shareholders’ holdings got diluted and the company took on even more debt.

Are Ocado shares a buy?

Although I think the industry the company operates in has a bright future, Ocado’s financials make me skeptical. I wouldn’t recommend a defensive investor to buy too many of Ocado shares.