Bitcoin is a much-hyped cryptocurrency, often presented as a better investment than FTSE 100 shares. But I strongly disagree. In fact, I think it’s pure speculation and the more popular Bitcoin gets, the more dangerous it becomes.

Bitcoin

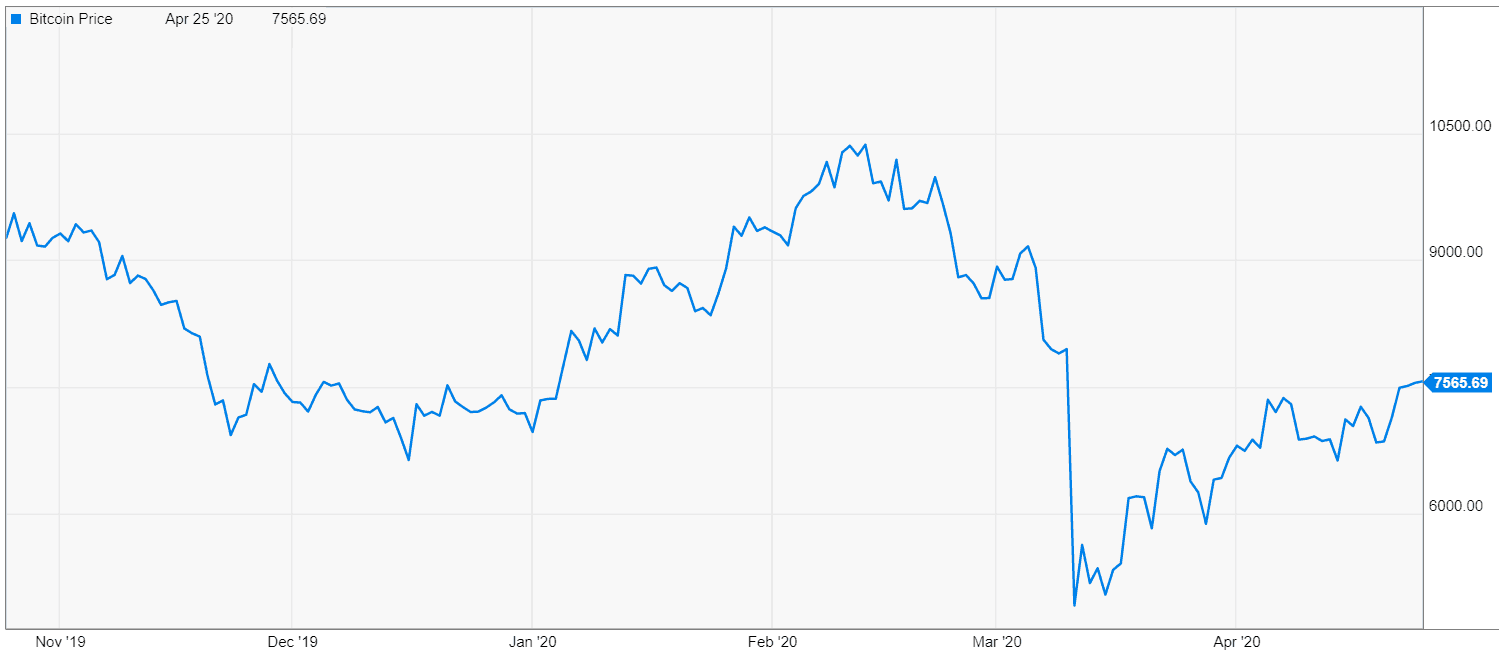

First, many people argue that Bitcoin and equity prices move in opposite directions, the idea being that when shares are down, Bitcoin is up.

However, this doesn’t seem to be the case. Many investors chose to get rid of Bitcoin and equities in March, destroying the former’s ‘safe-haven’ status.

Here’s a chart of the Bitcoin price in USD.

Source: Y-charts

Moreover, it’s a really volatile asset class. This means its price fluctuates wildly. In addition, not much is known about cryptocurrencies. There are currently few laws regulating them. So there’s a high risk that new restrictions could be imposed, limiting the use of Bitcoin in some countries. This sort of news would crash the price of the cryptocurrency. And of course, very few people know enough about Bitcoin’s intrinsic value. As I said, buying it is pure speculation.

FTSE 100

And the FTSE 100? It has a great recovery track record. Even though the situation might look quite scary after the major stock index decline in March, now might be the time to invest. There are two ways for an investor to benefit from the inevitable rally.

First, you could invest in a low-cost index fund. The benefits are that you would end up owning every single company worth having (as well as a few weaker names). At the same time, you would benefit from lower risk. It’s very unlikely that every single company would go bankrupt or stop paying dividends. That’s why legendary investor Warren Buffett has said he’s instructed his trustee to invest 90% of his family’s fortune into the S&P 500 index after his death, rather than picking individual stocks.

Buying companies

However, if you want to achieve market-beating results and are prepared to do research, you might be better off buying individual shares in addition to the whole index. I like companies with the lowest price-to-earnings (P/E) ratios. They tend to be undervalued compared to other companies. However, they’re normally cheap for a reason. That is, they often have poorer balance sheets and higher debt levels. So I regularly look at the list of the companies with the lowest P/E ratios and check their credit ratings. The key factors credit rating agencies consider are cash flow statements and balance sheets. These factors are really important because large piles of cash and low debt levels help businesses navigate through hard times.

So, after having done these checks, I came up with two financial giants — Legal & General and Lloyds. Legal & General’s dividend yield amounts to 9.46%. Lloyds, on the other hand, has suspended its dividends until the end of 2020. However, it’s a temporary measure to help the bank survive the bad times. Lloyds’ shares trade at a P/E ratio of about 9, while Legal & General’s P/E ratio is 6. This is extremely low.

Nevertheless, the financial sector is always the first to suffer during recessions because of lower interest rates and rising loan defaults. Both Lloyds and Legal & General are exposed to these risks. But if the crisis get worse, I think the government would most likely bail them out due to their size. These companies are my preferred options to get rich and retire early.