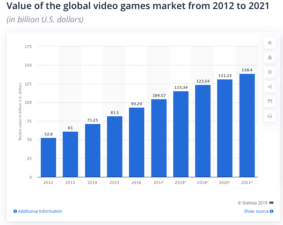

In recent years, the video game industry has experienced extraordinary growth. Driven by the success of games such as Fortnite, Call of Duty, and FIFA, as well as the increasing popularity of ‘e-sports’, video gaming has evolved from a niche hobby into one of the world’s favourite forms of entertainment.

Here in the UK, the video gaming sector now accounts for more than half of the entertainment market, while globally, the industry generates more revenue than the movie and music industries combined.

Source: Statista

For investors, this incredible industry growth is creating a lot of opportunities. With that in mind, here’s a look at a few ways to invest in video game stocks.

Video game ETFs

One of the easiest ways is to buy an exchange-traded fund (ETF) that focuses on the industry. These funds own a variety of different video game stocks, providing broad exposure to the gaming sector.

One such fund that’s available to UK investors is the VanEck Vectors Video Gaming and eSports UCITS ETF (ticker: ESPO). It owns 25 different video gaming stocks including Nintendo, Activision Blizzard (Call of Duty), and Electronic Arts (FIFA). You can invest in this ETF through online investment providers such as Hargreaves Lansdown for a low annual fee.

Investing in video gaming through an ETF is a smart approach, in my view, as it reduces your stock-specific risk.

Video game developers

Another approach is to buy shares in companies that develop games. In the UK, there are a number of publicly-traded video game developers including:

-

Team17, which has a portfolio of over 90 games, including the Worms franchise.

-

Frontier Developments, whose games including Elite Dangerous and Planet Coaster.

-

Sumo Group, one of the UK’s largest independent developers of AAA-rated video games.

-

Codemasters Group, which specialises in high-quality racing games.

There’s also nothing to stop you from buying shares in internationally-listed video game developers such as Activision Blizzard, Electronic Arts and Zynga.

Be aware, however, that buying shares in a specific video game developer is a higher-risk strategy. If a company’s games aren’t successful, the shares could underperform.

Video game support companies

Finally, a third way to gain exposure to this exciting growth story is to invest in companies that offer support services to the industry.

One such example is Keywords Studios (LSE: KWS), an AIM-listed company that provides technical services, such as localisation (translation and adaptation), testing, audio services, and art creation to game developers.

Operating in more than 20 countries across the Americas, Europe, and Asia, Keywords serves nearly 1,000 clients worldwide, including 23 of the top 25 most prominent gaming companies. Games it has worked on include Fortnite, League of Legends, Clash Royale, Rainbow Six Seige, and Call of Duty: WWII.

Personally, I see Keywords as a great way to get portfolio exposure to gaming as it’s very much a ‘picks-and-shovels’ play on the industry. No matter the success of individual video games, Keywords should do well as the industry continues to advance.

Keywords has grown at a rapid rate over the last five years (annualised revenue growth of 73%) and looks set to continue growing in the years ahead. At its current valuation (P/E of 29 using forecast 2020 earnings), I think it’s worth a closer look.